French Sovereign

-

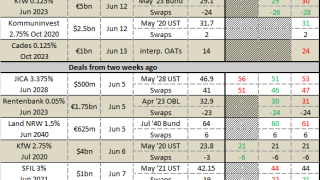

Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week's funding scorecard looks at the progress French agencies have made in their funding programmes as the first half of the year draws to a close.

-

-

-

The week began with that rarest of things in recent times, a welcoming political backdrop. It was marred, however, by monetary policy meetings from the two most important central banks in the world. While the US Federal Reserve’s second rate hike of the year was a foregone conclusion, it caused the dollar curve to flatten still further, making the euro market even more fertile funding territory than it has been for SSAs. But even so, euros had its own struggles this week, facing what one head of SSA syndicate called “one of the most important and unpredictable European Central Bank meetings for a long time”. Lewis McLellan reports.

-

KommuneKredit will hit the road next week to talk up a new green bond, while a fellow Nordic issuer is looking to enter the social bond market — although not for some time yet.

-

A French agency hit the short end of the euro market on Wednesday in what is likely the final SSA euro benchmark ahead of the European Central Bank’s meeting on Thursday.

-

While borrowers crowded into the euro market on Tuesday, investors were reluctant to commit funds only two days ahead of a hotly anticipated European Central Bank meeting.

-

CPPIB Capital will sell its first ever green bond this week, coming on the heels of a French region’s foray into green and sustainability bonds.

-

SFIL followed KfW into a reopened dollar market this week with only its second ever dollar benchmark, while engaging in a bit of price discovery that leads said was “spot on”.

-

KfW reopened the public sector dollar market on Wednesday by picking up a hefty $4bn from a well oversubscribed book. Société de Financement Local will be next up, after mandating banks for a trade.