France

-

French agency Société de Financement Local will launch on Tuesday its first ever syndication.

-

French glass packaging maker Verallia on Wednesday began testing investors’ thirst for risk with a €500m pay-if-you-can (PIYC) bond, the first of its kind issued since October 2015.

-

Alliance Automotive, the Blackstone-owned French car parts supplier, announced and printed an add-on to its LBO bonds in just one day, to fund the acquisition of UK peer FPS Distribution.

-

After a day of caution on Wednesday, when some issuers held back from the primary market after spates of volatility last week, unrated Air France-KLM timed its €400m deal right, showing that investors will still play for yield in higher risk names.

-

Just a week after its first dollar denominated benchmark, SNCF Réseau has announced that it will issue its first green bond.

-

BNP Paribas reshuffled some of the most senior executives at its corporate and institutional bank as it looks to boost cooperation between the business and its risk management division.

-

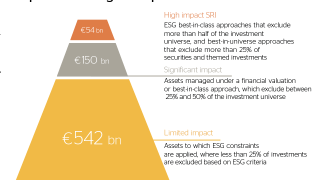

France’s sustainable and responsible investor base is notably more developed than those in many other leading economies. The country’s government is preparing to launch its first green bond. But the biggest change will come as French asset owners implement the new Article 173 law on disclosing their climate exposure, reports Julian Lewis.

-

Société Anonyme de Gestion de Stocks de Sécurité (Sagess) has picked four banks to arrange an investor roadshow for a euro bond, its first to be eligible for purchase by the European Central Bank.

-

BNP Paribas announced that its former head of the Netherlands will take on the role of UK country head, replacing Ludovic de Montille.

-

This week's scorecard looks at the progress French agencies have made with their funding as we move into the fourth quarter

-

-