Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

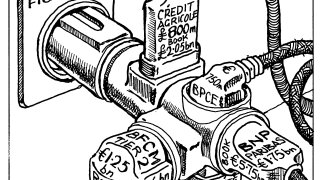

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

◆ Sentiment towards CRE exposed issuers far cry from February 2024's lows ◆ Aareal eyes replacing AT1 it has extended since April 2020 ◆ Switches from euros to dollars due to costs

-

◆ RV in sterling turns less favourable for issuers ◆ Investors 'underwater' on recent deals ◆ Asset managers see 'no fundamental change' in UK financials from higher Gilt yields

-

International banks launched a torrent of dollar FIG supply as they swatted away political uncertainty to get 2025 off to a rapid start

-

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ French bank prints third syndicated deal in just two days ◆ Frequency of visits means issuer has to pay up ◆ Euro tier two ‘better received’ than sterling tier two

-

◆ Second helping of French tier two on the day but no indigestion ◆ Spreads entice buyers ◆ The effect of 40bp of spread tightening on order book