Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

◆ Pent-up demand supports issuer set to regain IG ◆ Concession was 0bp-10bp, below what eurozone periphery smaller issuers have paid ◆ BayernLB chooses extra day of marketing for tier two

-

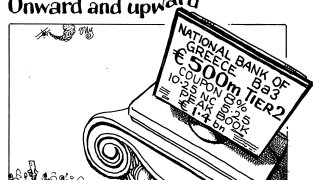

◆ Both deals are expected to price as early as Tuesday ◆ Unlikely to compete for demand due to differing ratings and buyer bases ◆ NBG will print the first Greek bond after Moody’s rating upgrades

-

◆ Swiss bank chose the US market for its double first outing after its Credit Suisse takeover ◆ Investors flock to the latest senior bail-in bond ◆ Some see it as precursor to AT1 return

-

◆ UBS to sell new Yankee a fortnight after last ◆ Holdco deal goes a step lower in the capital structure ◆ Some see it as precursor to AT1 return

-

◆ Spanish bank obtains regional investor diversification and fresh capital ◆ Deal highlights subordinated funding is cheaper in dollars than euros ◆ Other banks should be encouraged to issue in dollars

-

◆ Deal precedes redemption of AT1 and exacerbates shortage of paper in the currency ◆ Issuer locks in ‘very good’ arb ◆ HSBC’s third trade this week follows sterling covered and senior bonds

![06.02.2019, Singapore, Republic of Singapore, Asia - A view of the HSBC banking building in the business district. To the left of it you can see a part of the Fullerton Hotel. [automated translation]](https://assets.euromoneydigital.com/dims4/default/ab239ff/2147483647/strip/true/crop/4256x2394+0+0/resize/320x180!/quality/90/?url=http%3A%2F%2Feuromoney-brightspot.s3.amazonaws.com%2Fe6%2Ff7%2F61cd2ddc44dd8ce259b3365b1d98%2F2b759cn.jpg)