Top Section/Ad

Top Section/Ad

Most recent

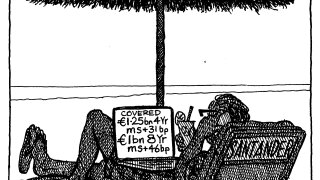

◆ Italian bank increased benchmark size to €750m ◆ Deal expected to perform in secondary ◆ Covered was one of two issued on Thursday

◆ Canadian bank lands tightest euro covered this year ◆ Further Canadian issuance on the day ◆ Banker on the deal said tranches were priced just inside fair value

◆ Austrian bank's first covered in nearly two years ◆ Both tranches offered 5bp of NIP says banker ◆ Modest 3bp tightening reflects 'normalisation' of covered market

◆ German bank secured spread tightening across tranches◆ Banker said first tranche offered small NIP but second had nothing ◆ Tuesday’s deals failed to deliver the spectacular order books of last week

More articles/Ad

More articles/Ad

More articles

-

◆ UBS ends 14 month Swiss franc covered absence ◆ Next to no premium paid ◆ Swiss bank has raised AT1, senior unsecured and now covered in the last week

-

◆ First offshore deal in sterling since PRA debacle in April ◆ Canadian undersupply driving demand ◆ Euro still better despite the UK Treasury's equivalence plans

-

German lender finds demand after record-breaking Pfandbriefzentrale deal

-

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

◆ First deal since Crelan/AXA Bank Belgium merger ◆ No premium paid ◆ Capped size allows for focus on price

-

Swiss bank is only the second institution globally to use the instrument