ESM-EFSF

-

The European Stability Mechanism practised its usual policy this week of offering a decent premium to attract a bumper order book. While some bankers felt that it was being too cautious — after all it was only looking for €3bn, a paltry amount by ESM’s standards — the strategy the supranational is playing is a canny one. Other issuers should take note.

-

Germany’s Joint Laender hired five banks on Wednesday to run a 10 year deal, while the European Stability Mechanism received a riotous reception to a long five year at sub-Libor levels.

-

The European Stability Mechanism mandated banks on Tuesday afternoon for what could be the only euro benchmark of the week, surprising with a five year maturity rather than the expected 10 year trade.

-

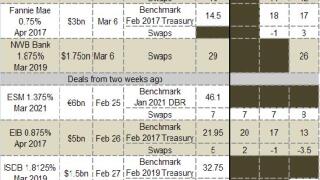

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Stability Mechanism is expected to take centre stage in the new issue markets next week as holidays in Europe and Asia make for a small window. The European bail-out borrower is tipped to mandate for a 10 year deal — although three and five years are also options.

-

The European Stability Mechanism is likely to take centre stage in a short opportunity for issuance next week. The rescue agency sent out requests for proposals on Tuesday ahead of a scheduled deal window next week.

-

The European Financial Stability Facility is expected to take centre stage in euros this week, mandating on Monday for a new benchmark deal. Two German agencies tapped the euro market ahead of the EFSF mandate, with rare issuer WI-Bank struggling through a 10 year print.

-

Norway’s Kommunalbanken is set to print its first euro benchmark bond this week, after mandating a group of banks on Monday for a €1bn no-grow five year deal.

-

This week SSA Markets provides funding updates on key European supranationals and agencies as we near the end of the first quarter. Click here to find out which issuers have completed nearly half of their 2014 funding requirements.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Financial Stability Facility completed its €14bn funding target for the first quarter of the year with a €2bn tap of its July 2018 bonds on Wednesday. Elsewhere in euros, Bank Nederlandse Gemeenten sold a €1.5bn five year benchmark and Cades printed a €1bn tap.

-

The European Investment Bank and L-Bank will add to a deluge of dollar issuance on Wednesday. The issuers mandated on Tuesday for benchmark deals on Tuesday, following deals by Denmark, Agence Française de Développement and the Bank of England.