ESM-EFSF

-

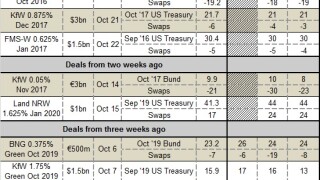

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Financial Stability Facility is likely to be one of the few issuers to test demand in euros next week, having sent out requests for proposals for a benchmark on Wednesday. Other issuers with euro needs are more likely to indulge in arbitrage plays next week, said SSA bankers, although a pair of borrowers printed small euro benchmarks on Wednesday.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Stability Mechanism took a novel approach to the sale of its shortest dated bond to date on Tuesday, printing a two year deal with what is understood to be the first ever 0% coupon on a benchmark from a supranational or agency. Agence Française de Développement is set to mimic the ESM’s tenor on Wednesday, after mandating banks for a long two year on Tuesday afternoon.

-

The European Stability Mechanism has opted to sell what will be its shortest dated bond to date on Tuesday, after mandating banks for a two year bond on Monday afternoon. Meanwhile, the State of North Rhine-Westphalia grabbed some funding at the long end of the curve.

-

The European Stability Mechanism has cut its funding target for the rest of the year by €2bn after Spain made an early repayment on its €41.3bn ESM loan for the recapitalisation of its banking sector. The move means that the ESM will be able to complete its funding for the year with just one more benchmark, said SSA bankers.

-

This week's scorecard features updates on the progess of selected European supranationals and agencies through their funding targets for the year. Most have almost reached their targets as we enter the final months of the year.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week's scorecard features updates on the progess of selected European supranationals and agencies through their funding targets for the year. Read on to find out where borrowers stand as several returned to benchmark issuance this week after the summer lull.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.