Middle East Bonds

-

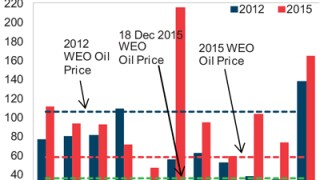

For a region often embroiled in political unrest, the Middle East’s bond market has historically been one of the most emerging economies. But 2015 was the year the drop in oil prices truly inflamed fears about the impact for capital markets issuance — the bond market will be there for Middle East borrowers in 2016, they just might not like the pricing Steve Gilmore reports.

-

Sharjah has become the first CEEMEA issuer to brave the bond markets this year, mandating six banks for a Reg S-only dollar sukuk roadshow and defying sceptics who said earlier this week that Middle East issuance would be postponed as geopolitical tensions in the region escalated.

-

Low oil prices and the absence of its biggest lender will see the global sukuk market shrink further in 2016 though a couple of brand new issuers are expected, according to Standard & Poor’s.

-

Middle East bonds have sold off further on Monday morning as tensions between Iran and Saudi Arabia escalated and Chinese stock markets fell, damming the flow of bonds from the region that had been expected.

-

Qatar National Bank priced its first Australian dollar deal on Tuesday.

-

-

-

Another week, another couple of difficult Middle East deals for the CEEMEA market. Bahrain and International Bank of Qatar hit the sizes they wanted but found that pricing stuck stubbornly at initial price thoughts, with international investors beginning to close up shop for 2015.

-

A 12 month roller coaster ride for US rates expectations has ended with the 10 year Treasury yield back where it started, and in the meantime the CEEMEA bond market has been turned on its head for completely unrelated reasons.

-

International Bank of Qatar (IBQ) has priced a $500m five year debut international bond deal. Although the lender hit its target on size, it became the fourth Middle East issuer in row to price a deal at the same level as initial price thoughts.

-

International Bank of Qatar (IBQ) opened books on a five year conventional debut deal on Wednesday morning as the Middle East keeps primary market supply running.

-

Bahrain took $1.5bn from a dual tranche deal this week. But despite the unusual size of each tranche and the lack of price tightening, rival bankers kept their knives sheathed in recognition of how difficult the Middle East market has become.