EIB

-

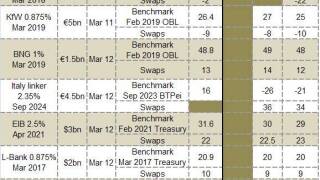

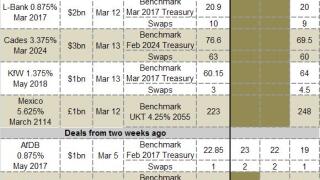

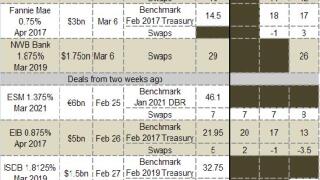

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week SSA Markets provides funding updates on key European supranationals and agencies as we near the end of the first quarter. Click here to find out which issuers have completed nearly half of their 2014 funding requirements.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Investment Bank sold the first sterling green bond from a public sector issuer on Wednesday, with the deal’s Climate Awareness Bond status contributing to a highly positive response from investors.

-

The European Investment Bank is set to break new ground in the green bond market after mandating banks for a six year Climate Awareness Bond on Tuesday — the first time a public sector issuer has attempted to print a green bond in the currency.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Cades and KfW were the latest issuers to add to a flood of dollar issuance on Wednesday afternoon, hiring banks for a 10 year and four year deal respectively. The European Investment Bank and L-Bank both enjoyed solid demand for benchmarks of their own on Wednesday.

-

The European Investment Bank and L-Bank will add to a deluge of dollar issuance on Wednesday. The issuers mandated on Tuesday for benchmark deals on Tuesday, following deals by Denmark, Agence Française de Développement and the Bank of England.

-

The European Investment Bank grabbed €5bn with a seven year euro benchmark on Wednesday. Elsewhere in euros, the European Financial Stability Facility sent out requests for proposals for a deal likely to come next week.

-

The European Investment Bank is set to sell an April 2021 euro benchmark this week after mandating banks on Tuesday. Demand appears strong in the euro market, after Dutch wind up agency Propertize drew a €1.9bn to its debut floating rate note earlier on Tuesday.

-

The European Investment Bank sold its fourth ever Climate Awareness Bond denominated in South African rand on Wednesday, catering to growing interest in socially responsible investing from retail investors.