EIB

-

Rentenbank was the first SSA borrower out of the traps in dollars in 2015 after mandating banks for a global deal on Monday. The European Investment Bank and Kommunalbanken are also rumoured to be planning deals in the US currency.

-

Having expected to hold off for a week or two, some sovereign, supranational and agency borrowers are rethinking their plans and contemplating the possibility of bringing forward euro issuance plans to this week.

-

The European Investment Bank is set to raise less in 2015 than it did this year, including cash to finance the European Commission’s plan to boost investment in Europe by €315bn.

-

Korea EximBank made a successful debut in Canadian dollars this week, easily topping its target size.

-

This week's scorecard features updates on the progress of selected European supranationals and agencies through their funding targets for the year. Read on to see which have room for one more benchmark in 2014.

-

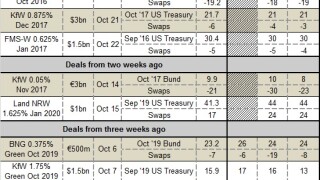

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Investment Bank, which has raised over €60bn of its funding target so far this year, expects to pick up funding in non-core currencies ahead of year end.

-

The green bond market has enjoyed one of the most remarkable weeks in its short life, with a series of deals that bankers say could help change the future of the market — and that all were priced roughly close to their issuers’ conventional curve.

-

This week's scorecard features updates on the progess of selected European supranationals and agencies through their funding targets for the year. Most have almost reached their targets as we enter the final months of the year.

-

Nordic Investment Bank tapped a short 10 year Kangaroo bond on Monday, while European Investment Bank added R400m ($37.4m) to a five year line.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.