Derivs - Regulation

-

The ban on uncovered sovereign credit default swap trading in Europe could permanently impair E.U.-regulated sovereign CDS markets and cause further market stress when combined with European Central Bank tapering, bank failure and lack of liquidity.

-

Market participants have returned to voice trading of swaps since swap execution facilities went live in the U.S. on Nov. 1, resulting in a drop in volumes on electronic trading platforms.

-

The Korea Exchange will encourage asset managers later this year to use volatility futures as underlyings for exchanged-traded products, such as exchange-traded funds or exchange-traded notes.

-

South Korea’s Financial Services Commission plans to impose sanctions in the form of fee assessments against parties involved in erroneous trading orders.

-

The Financial Conduct Authority will deal with breaches of the trade reporting mandate with a “proportionate response” after the start date for trade repository reporting of Feb. 12.

-

The Australian Securities and Investments Commission has accepted an enforceable undertaking from BNP Paribas in relation to potential alleged misconduct involving the country’s benchmark, the Australian Bank Bill Swap Rate.

-

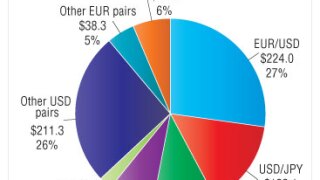

Average daily volume in over-the-counter fx instruments in the U.S. in October 2013 totaled USD816 billion, 19% down on April 2013, according to results of a survey released by the Foreign Exchange Committee of the Federal Reserve Bank of New York.

-

The International Swaps and Derivatives Association has announced Thomson Reuters will take on the process for moving the USD benchmark rate to an automated, market-based ISDAFIX setting from today, marking the start of a two-phase transition to an automated rate.

-

The Joint Association Committee on retail structured products has reiterated its position on packaged retail investment products legislation ahead of what market participants are calling a “crucial juncture” in E.U. discussions this week.

-

The Australian Securities and Investments Commission is considering waiving specific trade reporting requirements for international firms active in the over-the-counter derivatives market, and is currently in discussions with market participants over the issue.

-

Officials in Seoul are skeptical moves by the country’s financial regulator to open the market to greater product diversity will boost dwindling derivatives volumes.

-

The issuance of structured products through a trust vehicle could be challenging for firms following the formal adoption of the Volcker Rule last month, according to lawyers.