MUFG

-

Integrating banking and securities units intended to support growth

-

◆ Weaker and more volatile market but funding conditions attractive for banks ◆ Crédit Agricole, ING and MUFG turn to dollars ◆ Torrent of tier two

-

-

◆ Unlike Commerzbank, long end book holds together ◆ Premium paid ◆ Scarcity of Japan names in euros

-

-

Bank asserts ‘commitment to sustainability’

-

International banks launched a torrent of dollar FIG supply as they swatted away political uncertainty to get 2025 off to a rapid start

-

For the SRT Series finale, MUFG's head of FIG for the DACH region discusses the future of the market and her career to date

-

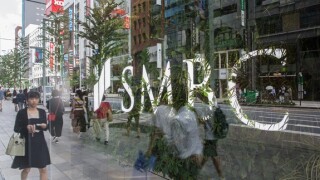

Japanese bank goes ahead of peers by merging bank and securities firm in EMEA

-

New head for Iberia recruited to grow capital markets and bank financing business

-

Tech firm to repay part of WMWare financing after biding its time

-

Japanese bank hires from within to drive European business