Cover story

-

◆ Size and execution the main attractions of dollars, but it costs more ◆ Well progressed UK banks weigh taking a chip off the table ◆ Dollar covered bonds unlikely

-

Development banks could issue hybrids up to a third of their equity

-

Investors and analysts fear central bank has not gone far enough in its fight against inflation following rally in bonds

-

◆ Supply, not demand, to determine summer pipeline ◆ Barbell market with top and low quality issuers the most welcome ◆ Opportunistic funders the most likely summer candidates

-

Curve tightens as supra undercuts issuance expectations but uncertainty remains amid ‘bottleneck’ loan delays

-

'Relief rather than fear' for investors missing higher yielding deals as they dodge deals from minnows in favour of benchmarks

-

Silicon Valley Bank’s collapse in March postponed the pipeline of state selldowns

-

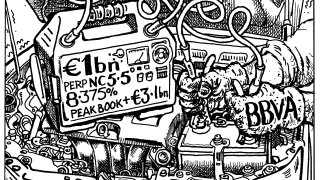

Demand for high yielding paper drives comeback for most subordinated bank capital

-

Eager investors appear willing to ignore hawkish signs with more borrowers likely to contemplate bonds

-

The soda ash company failed to convince risk-averse investors to accept its valuation demands

-

The bills have the potential to do damage to both New York and sovereigns themselves, say sources, while others urge change

-

Wave of deals comes after some borrowers had shunned dollars for months or years