Cover story

-

-

At least two issuers pulled bonds after lukewarm investor responses

-

Moody’s expects the pace of dollar loan and bond issuance to decelerate

-

Borrowers find opportunities to manage balance sheets amid weak market conditions

-

Country Garden makes equity placement as market rebounds but mortgage protests threaten sector recovery

-

Worries that a new sovereign debt crisis is looming, despite central bank raising rates by 50bp and detailing new policy tool to manage govvie spreads

-

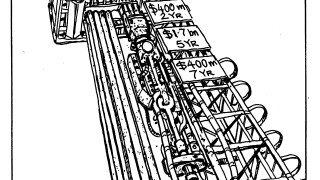

Three borrowers raised a combined $2.45bn on Wednesday despite pressure in the secondary bond market

-

Banks working on US term loan Bs are being forced to switch tack on their syndication strategies

-

Listings in the country have held up this year against all odds, with more in the offing

-

SSA issuers to get used to dancing around more frequent market-quaking events

-

The recent rush of European FIG credits to the Lion City is set to wind down

-

Indonesian oil and gas major makes loan debut but would have to steer the deal through some sceptical lenders