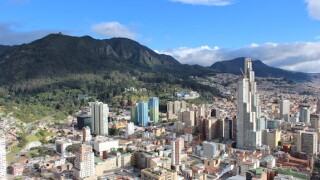

Colombia

-

Colombian airline Avianca’s senior secured bondholders will be able to recover around 45% of their principal if they agree to provide debtor-in-possession (DIP) financing to the company, which has been in Chapter 11 bankruptcy proceedings since May.

-

Latin American development bank Corporación Andina de Fomento (CAF) raised Sfr350m ($382m) of five year paper on Monday with its first green bond issue in the Swiss franc market.

-

The Inter-American Development Bank (IADB) said on Monday that it would elect its next president virtually in September as it rescheduled its annual meetings for the second time.

-

The run of new bond issues from Latin America credits looks set to extend this week after the slew of corporates from the region to tap the market last week mostly emerged with a combination of slim new issue concessions and positive aftermarket performance.

-

Latin America has been taking the spotlight in July after a record-breaking quarter for emerging markets bond issuance, but with US elections looming and all-in yields still very attractive, bankers across the emerging market world say there are plenty of reasons for issuers to continue to flock to markets.

-

Two Colombian companies kept corporate issuance from Latin America ticking with aggressive deals on Wednesday even as bankers reported softer conditions in US investment grade bond markets

-

Colombia may have arrived late to the coronavirus-era Latin American sovereign bond market party, but the wait paid off on Monday as the sovereign notched a dual tranche $2.5bn issue that included its lowest ever coupon on a long dated bond.

-

Latin American development bank Corporación Andina de Fomento expects the social bond universe to grow after bringing forward its debut social bond to raise funds for its Covid-19 mitigation efforts.

-

The president of Grupo Energía de Bogotá (GEB) told GlobalCapital that the issuer’s faith in demand for its bonds had allowed it to tighten pricing sharply on its long-awaited return to bond markets last week, as the company waits for an improvement in domestic market conditions to continue its capital markets activity.

-

Latin American development bank Corporación Andina de Fomento (CAF) began investor calls on Monday as it looks to sell a benchmark-sized euro denominated social bond to help fund its response to the Covid-19 pandemic.

-

Holders of Avianca’s international bonds are keenly watching the Colombian government’s next move after the airline filed for Chapter 11 bankruptcy protection in New York.

-

Grupo Energía de Bogotá (GEB), the Colombian electricity and gas distributor, tightened pricing sharply on a new 10 year deal as bankers reported huge appetite for the pick-ups being offered by the sturdiest investment grade EM companies.