Central and Eastern Europe (CEE)

-

CEE borrowers offering dollar deals will find good demand, says one fund manager

-

Books were over $2.5bn in the early afternoon

-

A fellow Hungarian bank and a Kazakh debutant are preparing dollar bonds

-

Most dollar bonds from corporates in CEE have come from Turkey or Russia

-

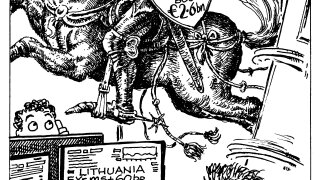

Lithuania paid little to no new issue premium

-

The country plans to raise more than it ever has before on overseas markets

-

-

A straight dollar bond is the most likely format, but it has discussed other options

-

-

January issuance from CEE FIG borrowers got off to a good start

-

The Slovenian bank has not issued a bond in nearly a year

-

Books reached close to $10bn but lost a few billion after tightening