Canada

-

A widening in dollar swap spreads since the end of last week should help support a trio of dollar deals on screens for Wednesday’s business, said SSA bankers.

-

Appetite for quality dollar issuance is strong as 10 year Treasury yields hover above 2.54%, prompting two borrowers to hit screens on Monday with dollar benchmarks.

-

Price sensitivity is becoming a material theme in covered bond deals issued this week, and the first Canadian covered bond of 2018, issued by Bank of Nova Scotia on Friday, was no exception.

-

The sterling covered bond market enjoyed a strong start to the year, with four issuers raising a collective £3.7bn. Barclays priced the first deal of the year, which also happened to be one of the longest and largest.

-

Canadian public sector issuers had a barnstorming year in the international debt markets in 2017, propelled by a strong economic performance by Canada and many of its provinces. But challenges loom — uncertainty over Canada’s trade relationship with the US, geopolitical instability and changing global monetary policy are just three of many concerns that borrowers, bankers and investors in Canada’s public sector bond markets will have to deal with this year. GlobalCapital met key market participants in Toronto in November to discuss the key issues.

-

SSA bankers looking to get their Christmas shopping in early were in a state of shock on Tuesday, as the World Bank brought a dollar deal to follow the Province of New Brunswick’s return to the currency after a six year hiatus. But that could be it for 2017 as issuance is unlikely next week, which is bisected by a Federal Open Market Committee meeting.

-

SSA bankers looking to get their Christmas shopping in early were in a slight state of shock on Tuesday, as World Bank lined up a dollar deal to follow a Canadian province’s return to the currency after a six year hiatus.

-

Royal Bank of Canada not only found good demand in a larger than average size for its five year sterling covered bond on Friday, but also executed the trade at considerable cost advantage compared with dollars and euros.

-

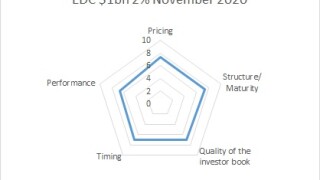

The votes have been counted and the results are in. The BondMarker voters have delivered their verdict on the Export Development Canada (EDC) benchmark

-

Export Development Canada this week brought what could be the last SSA dollar benchmark of the year, printing a strong deal despite conditions weakening as 2017 draws to a close.

-

-

The Province of British Columbia (BC) completed its second Panda bond on Wednesday, raising Rmb1bn ($150.9m) from a three year deal. The issuer went ahead with the deal despite rising yields in China – pushing the coupon to the top half of the guidance range.