CAF

-

◆ Supranational was 'hesitant' to print on Monday ◆ New issue concession estimated ◆ Timing of cross-currency swap execution

-

◆ Investor appetite for five year SSA sterling paper remains strong ◆ New issue concession estimated ◆ SSA sterling volume for January ahead of last year's full month total

-

◆ Return to 10 year gets deep demand ◆ Spread vs peers had tightened ◆ 'Quite exceptional' primary markets

-

Issuer plans to go longer in dollars and venture into new markets like Canadian dollars, and potentially bring another hybrid deal

-

CAF's Manuel Valdez discusses the issuer's huge blowout and future funding opportunities

-

◆ CAF record breaker as bond 'flies' in secondary ◆ IDA unscathed by recent volatility ◆ Investors and issuers both favour seven year segment

-

◆ Issuers brave Middle East war uncertainty ◆ CAF gets another big book ◆ IFC, JBIC return to fixed rate dollars

-

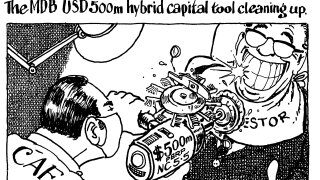

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

◆ LatAm development bank adds to funding toolkit ◆ Patience is virtue as issuer waits out tariff storm ◆ Book ended up 6.4 times covered

-

Deal announcements fall below expectations but SSA investors remain ‘cool-headed’

-

Mandates flood in for dollar and euro deals as EU prepares to offer dual-tranche deal