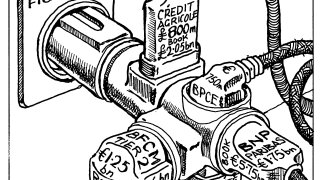

BNP Paribas

-

◆ France first out of the door with 30 year ◆ Large book of €115bn, over 450 investors ◆ 'Very compressed' premium like EU and Italy

-

◆ French bank offers premium to investors to attain size target ◆ Deal is the tightest and longest French euro tier two in 2025 ◆ Rare Ibercaja also goes longer than the norm

-

◆ Record book and deal size ◆ Investor demand 'at odds' with media headlines ◆ Key BoE actor clears up position

-

◆ Issuer initially targeted price over size but achieved both ◆ Makes sterling debuts look easy ◆ Positioning for UK membership?

-

◆ Rare euro appearance from Norwegian agency ◆ Deal was 'one of the most successful' ◆ Differential to KfW gets tight

-

◆ Large tightening in line with recent trades ◆ Prices flat or through fair value ◆ No French agency deals expected next week

-

◆ Cades tightens pricing by 5bp ◆ French political backdrop helping asset class ◆ Deal subscribed over 10 times

-

Book for its newest deal was second in size only to a QE-era transaction

-

◆ Views on fair value differed ◆ France syndication ‘the next big test’ ◆ Supra attracts €60bn final book

-

◆ Bloc takes more than bankers anticipated ◆ Triple-digit orderbook for long-dated tap ◆ Bankers agree on fair value

-

International banks launched a torrent of dollar FIG supply as they swatted away political uncertainty to get 2025 off to a rapid start

-

Warm reception for French banks in euros and other currencies shows FIG market is in positive health