Bank Nederlandse Gemeenten

-

KfW priced a more than twice subscribed Kangaroo bond on Wednesday — its first deal in the format this year — as other supranationals and agencies lined up with taps and new issues for their own inaugural 2015 Australian dollar deals.

-

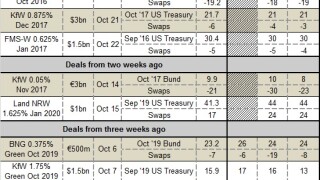

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Bank Nederlandse Gemeenten could be the next agency to issue an SRI benchmark, having hired banks to arrange investors meetings in Europe over the next two weeks.

-

Bank Nederlandse Gemeenten has closed books on a Canadian dollar five year bond that was originally planned to be a purely domestic Maple deal but ended up as a Reg S/144a bond with a ‘Maple wrapper’ that allows domestic Canadian investors to buy the paper, SSA Markets understands.

-

Bank Nederlandse Gemeenten has opened books on the first Maple bond from a public sector issuer since 2011, SSA Markets understands.

-

Bank Nederlandse Gemeenten opened books for a September 2019 Kangaroo on Tuesday, its first new five year Kangaroo line since 2011. The issuer also visited the Kiwi market for the second time in 2014 with a NZ$100m ($82.7m) six year bond.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week's scorecard features updates on the progess of selected European supranationals and agencies through their funding targets for the year. Read on to find out where borrowers stand as several returned to benchmark issuance this week after the summer lull.

-

Unédic is set to become the third issuer to bring a euro benchmark after the summer break on Friday, following deals for Finland on Wednesday and Bank Nederlandse Gemeenten on Thursday. BNG deal was twice subscribed, which was priced just as tensions between Russia and Ukraine escalated on Thursday morning.

-

Bank Nederlandse Gemeenten is next in line on the euro benchmark conveyor belt, having mandated banks on Wednesday afternoon for a deal. Finland hit the ‘go’ button earlier in the day, building a more than twice subscribed book for a deal that was priced at the tight end of guidance.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.