Banks

-

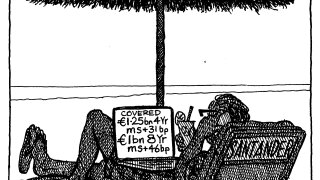

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

Bank goes further than Crédit Ag and SocGen in avoiding regulatory call

-

Half year FIG issuance, powered by more than 50% Yankees, reaches record $307bn volume

-

Bulge bracket firms are hiring from each other in a war for talent to woo financial sponsors

-

◆ Swiss bank issuance is novel for the euro FIG market ◆ Mixes elements of senior and covered FIG debt, and SSA bonds ◆ State-backed deal performs well

-

-

◆ Positive market backdrop for larger and smaller issuers ◆ Canadian bank taps favourable euro funding at similar level to the US market ◆ Smaller Italian lender Sella crunches spread from a year ago

-

Internal hire ends seven year stint in covered bond research

-

◆ Société Générale's insurance arm refis legacy perp ◆ Deal lands flat to fair value ◆ Investor sweet spot

-

◆ Inaugural green deal from issuer ◆ Low beta offering draws good order book ◆ Investors may be looking further up the capital stack

-

Investors are thirsty for yield and willing to sacrifice spread

-

Firm’s tailored package for UK nuclear project is new milestone in private credit’s advance into investment grade lending