Banks

-

◆ Deal first in sterling from Australia since late 2024 ◆ Trade prices flat to euros ◆ October redemptions could drive further supply

-

◆ Almost €700m of orders lost… ◆ …but deal still prices tight ◆ Trade Commerzbank's third five year this year

-

Senior banker joins from EIB

-

◆Rabo reenters euro senior market after more than a year away ◆ 'Pent-up demand' swells order book ◆ Green senior bail-ins down on 2024

-

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

-

◆ Japanese bank's longest senior bond in euros ◆ Adds call option similar to its dollar funding ◆ Strong demand in anticipation of low issuance volumes

-

◆ Demand sticky despite tight spread ◆ Next to no concession offered ◆ Pick-up to SSAs not a concern

-

Deal opens door for more foreign FIG regulatory capital raising Down Under

-

CBA and Nationwide senior bonds push monthly FIG tally to just shy of $80bn

-

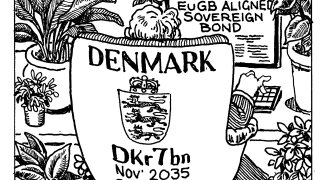

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

◆ Dutch bank takes €1.5bn at four years ◆ Little resistance to pricing through 20bp ◆ Sticky book allows for tight final level

-

◆ Second SP deal from SEB this year... ◆... becomes longest point on its euro curve ◆ Some concession left as 'the right compromise'