Awards

-

EM Achievement awards are not designed to trumpet those banks with a full-service, pan-regional franchise. HSBC’s balance sheet strength, its 19th-century roots in Asia and its unparalleled global presence are now almost unremarkable facts of global finance. But HSBC is chosen for particular praise because of its aggressive plan to re-attach itself firmly to Asia’s growth engine.

-

CIMB announced at the end of August a 34% increase in April-June net profit at 889 million ringgit ($283 million). Like many banks, the increase is down by lower loan loss provisions. But where it differs is in the strong performance in its Indonesian unit, with net profit in the first half of this year at 1.13 trillion rupiah ($126 million).

-

-

-

-

-

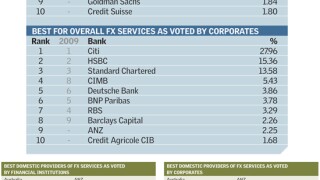

The region is witnessing a rise in money inflows from corporates and investors alike looking to benefit from strong economic expansion and China’s renminbi liberalisation. It is a robust environment that stands in contrast to stagnation in Europe and the US. According to ASIAMONEY’s latest FX poll, Citi and HSBC, in particular, are benefiting from these trends.

-

Asiamoney.com publishes the results of its latest annual Foreign Exchange Poll, revealing the best global banks for FX services in Asia and the best within each respective country. This is our 20th and largest ever FX survey, with the results based on 2,082 valid responses.

-

See the photo gallery for Asiamoney's Summer Awards 2010, held at the Four Seasons, Hong Kong here.

-

The two global banks are considered the best regional providers of foreign exchange by corporates and financial institutions, respectively, according to the most numerous number of voters yet.

-

International banks are trying to expand cash management services in Asia more aggressively than ever, as the region’s economic growth outpaces the rest of the world. But succeeding requires a deft mix of customer support, local presence and global capabilities.

-

The two banks have impressed more of the region's financial institutions and corporates than ever, in ASIAMONEY's 20th annual survey of cash management services in Asia-Pacific.