Top Section

Top Section

India is on track for a record year of IPOs. Global tech giants continue to plough capital into a fast-growing consumer economy that is investing heavily in ensuring it’s a major player — along with the US and China — in an AI-first world

◆ Deal finds demand despite arrest of South Korea's president ◆ High single digit concession left for investors ◆ Leads added spread to calm concerns

South Korean policy lender kickstarts 2025 funding following a month of political chaos

More articles

More articles

More articles

-

The two southeast Asian credits joined a host of other dollar issuers keen to get ahead of the September rush

-

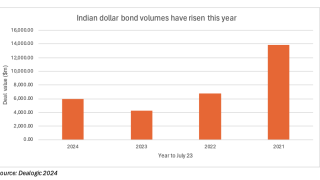

Cheaper funding costs for borrowers and a yield pick-up for investors have created a win-win situation

-

ESG presents a huge challenge to Asian issuers, but sustainability-linked bonds are primed to take a bigger role

-

Region’s investors are keen to buy global bonds, while non-Asian issuers are looking to leverage Asia’s liquidity

-

FIG issuers lead the way offshore, but attractive domestic debt markets to keep dollar volumes contained

-

Innovation, strong execution and supply dearth benefit Indian issuers

shared comment list