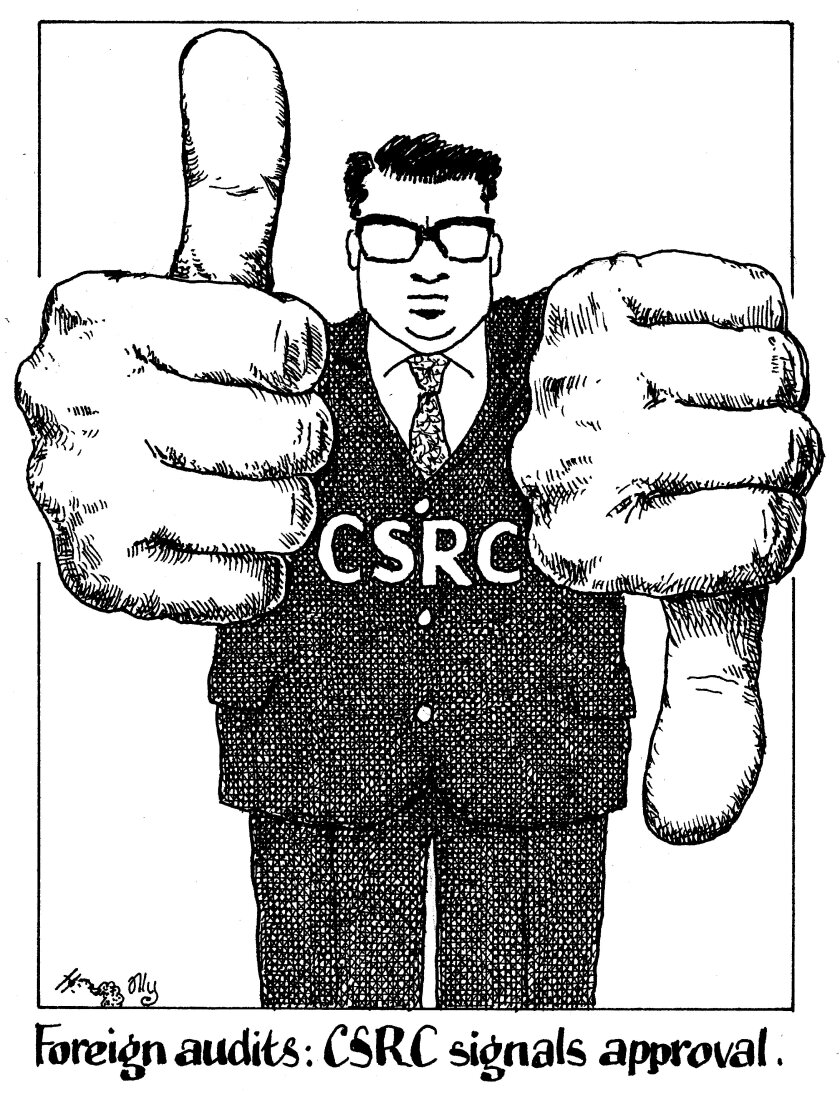

Beijing’s top securities regulator made a critical announcement over the weekend: it put out rules that grant foreign auditors the ability to do their own inspections of Chinese firms listing offshore. But before celebrations begin, investors and ECM bankers need to take a closer look at the small print.

The China Securities Regulatory Commission is amending a rule that restricts Mainland-based companies from handing over financial information to overseas regulators, access that US authorities have been seeking for years. The changes would remove the requirement for on-site inspections to be only conducted by Chinese regulators, or for foreign regulators to rely on domestic inspections.

However, the draft framework, revealed on April 2, outlines that China would assist foreign regulators when inspecting the data of offshore-listed Chinese firms through a cross-border regulatory co-operation mechanism.

This raises plenty of questions — critically on how this mechanism would work in reality and the extent of the co-operation between different regulators. But what is clear is that Beijing would still be involved in the process.

It’s yet to be seen if these amendments would cut it for the US regulators, who have developed a serious mistrust of their Chinese counterparts over the past decade. What the US authorities have long demanded is the ability to produce their independent audit reports on firms listed in the US. Whether they will get that from China’s proposed co-operation mechanism remains a question.

Additionally, the CSRC proposals still limit foreign auditors’ and regulators’ access to companies that handle data pertaining to national security. Instead, the onus is on such firms to guard their sensitive data themselves — a double-whammy for data-based businesses looking to float offshore.

A large chunk of the China-US listings market consists of new economy companies that deal with Chinese citizens’ data. Beijing’s crackdown on the technology sector and overseas IPOs last summer showed how fiercely protective it is of that data, which is deemed significant to national security.

With that knowledge, prospective issuers are likely to be cautious about the level of access they give to foreign auditors.

But again, the devil will be in the detail. Firms planning offshore IPOs will still have to get approvals from various government authorities, so how much responsibility and control they have over who they can share their data with remains to be seen.

Any changes to the rules will be most significant for the US market. After years of butting heads, more clarity on the regulatory framework for China into US IPOs is urgent, if only to reduce pressure on the stock market, which has taken a severe hit in the past year.

The door to the US was slammed shut for Chinese firms almost a year ago, when Beijing began a cybersecurity review of ride hailing giant Didi Global just days after its $4.4bn New York Stock Exchange IPO. Prospective offshore IPOs were subsequently shelved, and for those that did push on, the US Securities and Exchange Commission put up a wall, effectively declining to approve Chinese listing applications.

Since Didi’s IPO on June 30, the Nasdaq Golden Dragon China index, which tracks the American depository shares (ADS) of Mainland issuers, has fallen 49.15%. Since then, just four Chinese issuers have listed in the US, with only one raising over $100m, according to Dealogic data.

This means if Chinese companies want access to US bourses again, they will need to play by the local rules.

The US SEC also last month showed what could happen to firms unwilling to open up their books to foreign auditors. It published a list of Chinese companies that face possible delisting from New York’s stock exchanges, hitting market sentiment again and causing a rout in technology stocks.

Following the CSRC’s announcement, the Nasdaq Golden Dragon China index climbed 7.38% on Monday, but traded down 4.64% on Tuesday to close at 7,574.14 points.

If China and the US can agree and act on a satisfactory level of co-operation, the benefits to the market will be obvious and swift: an improvement in investor sentiment and issuer confidence, followed by an increase in deals and market liquidity.

But given the lack of real detail so far, what shape and form this co-operation agreement will take is up for debate. There may yet be light at the end of the tunnel, but for now, there is little respite for issuers and investors.