This time last year A-shares were on a tear, with retail investors loading up on margin debt and the government openly endorsing stock purchases. Then came the summer rout, and just as investors try wiping the slate clean for 2016, China is spooking markets again.

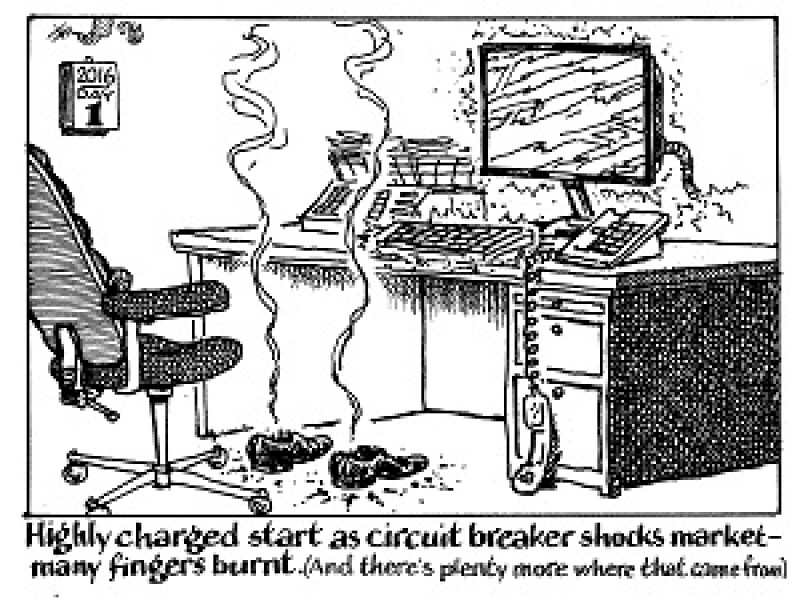

The CSI 300 index, which tracks stocks in Shanghai and Shenzhen, fell 5% in Monday morning’s trading session, causing a 15-minute trading halt. And at around 1.30pm trading was suspended for the rest of the day as the index slid 7%, triggering a new circuit breaker that came into effect that very day.

This marked the shortest trading day in the Chinese stock market’s 25-year history, and the panic spread to Europe and the US. What was supposed to be a backstop only ended up having the opposite effect, as investors scrambled for the door to avoid getting trapped by the full-day suspension.

On the face of it, Monday’s plunge paints a weak picture for equities. It has ignited fears that the slump could roil the pipeline in Asia’s equity capital market, with some taking it as a sign that investors are increasingly reluctant to put money into the region.

But the fall should not be a harbinger for how the primary market will play out this year. Wild swings in the A-share market are not uncommon, as seen during the 2015 summer sell-off. That the index lost 7% in one day says nothing new about the idiosyncratic Chinese investor, most of whom are retail.

It’s worth keeping in mind that with many institutional investors still away from their desks, any market moves up or down will be exaggerated. January is also a slower month for IPOs in China and Hong Kong as the Chinese New Year holidays backend deals to February or March. Many of the larger listings are earmarked for some time during the first half of 2016 or are yet to decide on timing.

In addition, preliminary filings to the Hong Kong Stock Exchange have thinned out, indicating that few floats are planned for this time of the year anyway.

Where the rout could complicate matters is in block trades, since investors like to start January with a new scorecard and the buyside has money in the kitty.

But heightened volatility should hardly be an excuse after the summer sell-down. If there can only be one takeaway from that period it is that while China can roil markets, given time and provided bankers and issuers do their homework and are reasonable, deals can get done.

For a recent example, look no further than the IPO of Virscend Education Co, for which bookbuilding could not have kicked off at a worse time when it started taking orders this week. But despite the high asking price, demand is looking solid for the HK$2.19bn ($282.50m) float.

Moreover, if all else fails, the Chinese government and its state-owned units tend to be a dependable backstop. Money from state investors scarcely runs dry, as seen by how heavily supported state-backed listings were in the final quarter of last year.

Already, the government is said to have moved to support the stock market by buying equities and considering extending a previously imposed ban on stock sales by major shareholders of listed firms.

If a year ago Chinese stocks were a one-way bet, then the only sure bet now is that it will be volatile. But that’s the market’s new normal, and those willing to ride out the volatility, however hair-raising, will get their reward.