Asia Pacific

-

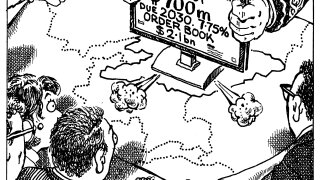

New issue premium estimates at IPTs ranged from 37.5bp to 50bp

-

The Uzbek uranium miner is the 'little brother' of state-owned gold miner NMMC

-

Markets continue to remain benign, according to one EM syndicate banker

-

◆ Scotia and Bank of Queensland tap the short end ◆ Single digit premium for Scotia ◆ BoQ offers spread to Aussie major peers

-

◆ Philip Morris flattens short end curve by 7bp ◆ EssilorLuxottica lands with single digit concession ◆ Wesfarmers increases deal size

-

Pricing was tight after sovereign found healthy demand

-

◆ Aussie lender ends more than two year absence ◆ Little or no premium paid ◆ Deal lands close to eurozone paper

-

The country is set to offer less than 100bp of spread over Uzbekistan

-

The Aussie bank will visit four European cities next week during the deal's roadshow

-

◆ Fair value debated ◆ Some question RV attractiveness to global investors ◆ Dollars main funding market ‘for now’

-

The Kazakh bank is the fifth largest bank in the country as measured by assets

-

◆ Japanese bank returns to euro market after many years ◆ Global asset managers reducing US dollar exposure ◆ Euro issuers facing increased competition