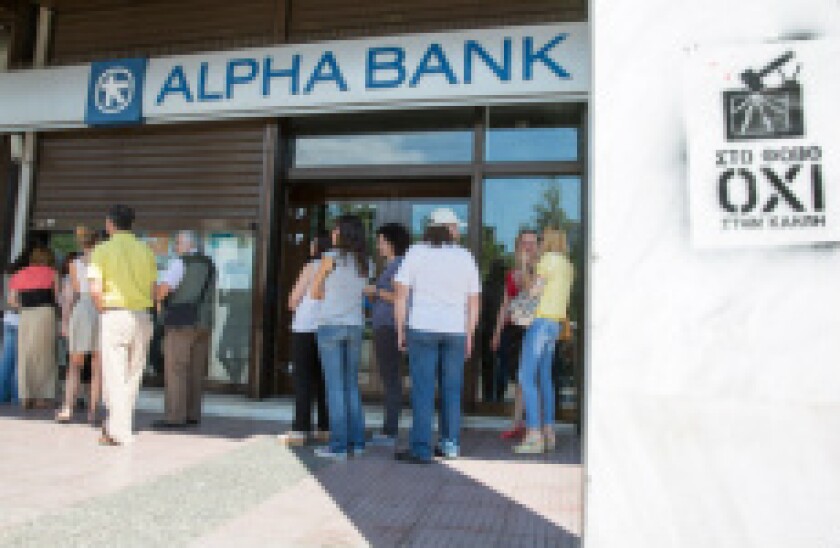

Alpha Bank's restructured CPT covered bond bodes well for market return

After restructuring its soft bullet programme to a conditional pass through (CPT), Alpha Bank’s covered bonds have been upgraded to Baa3, making them eligible for repo with the European Central Bank, thereby improving their appeal with investors, putting the bank in a stronger position for a return to the market.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts