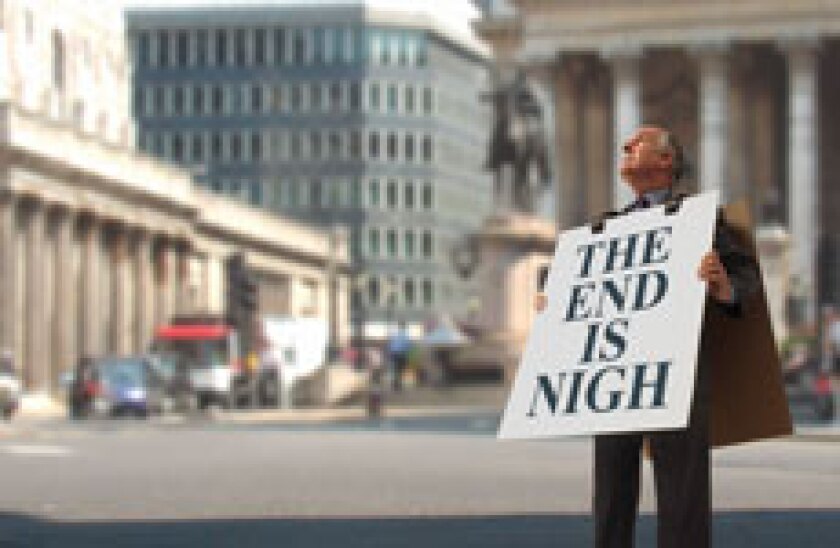

‘Game changers’ see bonds take first step towards end of QE

The European bond market this week finally showed its first acknowledgement that the end of European Central Bank (ECB) quantitative easing (QE) is nigh. Opinions are still split as to whether the bond buying will end in September or be extended to December, but new issue pricing has stepped wider regardless, write Nigel Owen and Bill Thornhill.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ 4 capital markets databases

- ✔ Daily newsletters across markets and asset classes

- ✔ 2 weekly podcasts