Goodbye, farewell and tot ziens.

After almost 20 years, Dutch pension funds are set to lose their status as the dominant players in long-dated European government bond and swap curves.

Their primacy emerged after 2007 when they began discounting liabilities using the Euribor interest rate swap curve — propelling them as a force to be reckoned with at the long-end of euro curves.

An unexplained flattening in the 10 year versus 30 year? Most likely Dutch pension funds became the common adage.

But now all that has begun to change.

After years of proposals, a couple of delays and some cliff-edge votes in parliament, Dutch pension funds have begun transitioning from providing defined benefit to defined contribution schemes in a move set to be completed by January 2028.

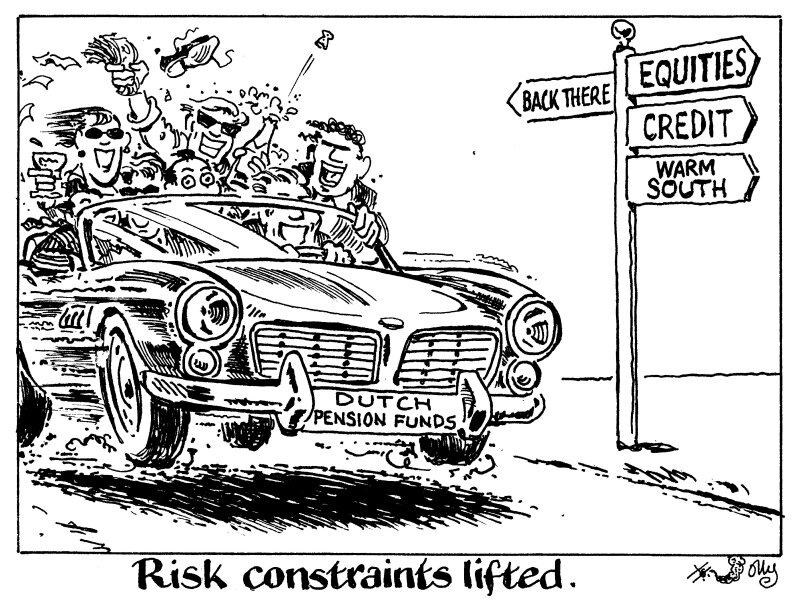

With risk constraints lifted, the funds are disposing of large buckets of long dated and highly rated EGBs — mostly Dutch and German.

Rabobank estimated that Dutch pension funds held as much as €450bn in EGBs before the transition started.

Now, expectations are that much will be funnelled into credit and equities.

But it might not be bad news for all European debt management offices as Dutch pension funds are not expected to fully divest of EGBs.

In the words of one southern European DMO official speaking in June at a conference, although the transition is set to steepen curves it could "open up space for sovereigns that offer higher pick-ups".

That is already the case for European insurance companies — who will be taking over the mantle as the main liability-driven investors left in the long-end — as data published by their EU regulator showed they hold a bias towards holding Spanish and Italian government bonds.

Also worth remembering is that Spanish and Italian sovereigns are both candidates for upgrades by the credit rating agencies.

A big loss for Dutch and German govvies could finish as a win for the Spanish and Italian offerings.

Whatever the decisions, the transition is a momentous opportunity for funds to switch up their fixed income portfolios and southern Europe — for so much of the last two decades the hairier end of the EGB market but lately outperforming the core — could catch even more of a bid.