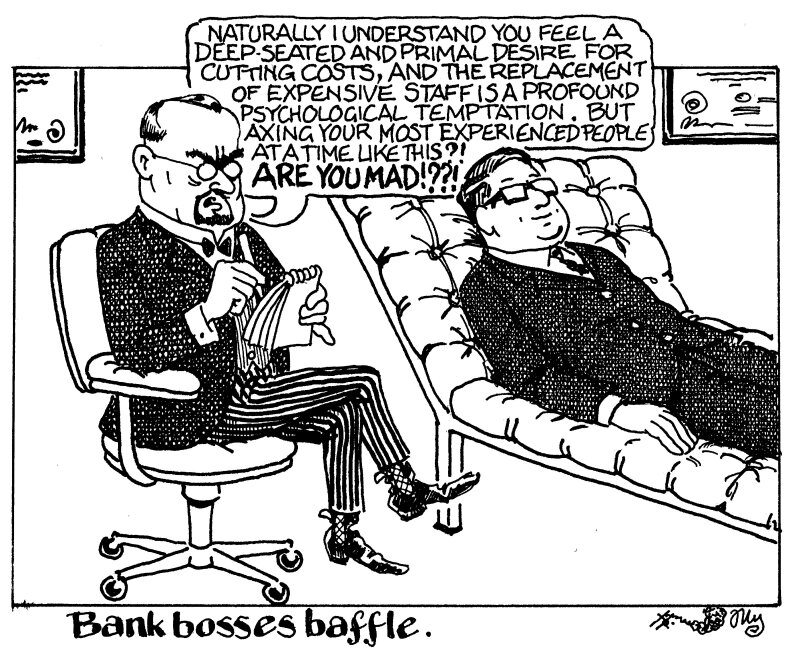

There is a great staff rotation happening on bond syndicate desks, with experienced bankers being replaced by cheaper juniors across many major banks. This is an absurd time for bank management to take this route.

As GlobalCapital has reported over the last few weeks, bank bosses have been swinging the axe across their syndicate desks, particularly targeting very senior staffers.

Names that many in the market, including borrowers, know, are no longer running desks. Armin Peter at UBS, Chris Agathangelou at NatWest Markets, Sean Taor at RBC Capital Markets, Damien Loynes at Crédit Agricole and Keval Shah at Lloyds have all left their posts and been replaced with junior members of staff coming up through the ranks.

Some of this is just natural attrition. And it is not to say the next generation to whom authority is passing are not capable — no doubt they are shining examples of investment banking intellect and skill. But it is a question of experience, which can only really come with time spent at the desk.

And experience is more valuable now than it has been for years.

For the last decade, the bond market has been homogeneous. Central bank bond buying sucked credit risk out of the market and the main concern was how low yields were, dipping into negative territory for top rated borrowers.

Anyone who started their investment banking career after the global financial crisis has not really had to deal with a normal market before 2022.

But quantitative tightening means credit risk and differentiation are real again. There are untold nuances in the market that banks need to be sensitive to and reacted to quickly to get the best results for borrowers.

Just this week, Vonovia, the German housing company, tightened a bond issue by 40bp and priced it inside fair value, weeks after announcing an eye-popping €6.8bn record loss for 2023.

On a less happy note, Equinix recently had to yank its trade towards the end of bookbuilding after a short-seller attack.

In both these out of the ordinary situations, the issuers would have benefitted enormously from having bankers in their syndicate groups able to draw on experience to guide them towards the best, or the least damaging, outcome.

Younger generations of bankers do need to be promoted and advance in their careers.

But it is baffling when, at a time like this, a bank simply cuts a managing director from a desk, leaving it without the benefit of his or her experience, without any commensurate replacement. It’ll end in tears.