Syndicated Sovereign Bond of the Year

Spain

€13bn 3.55% October 2033

Barclays, BBVA, Crédit Agricole, Deutsche Bank, Goldman Sachs and Santander

Sequels that are better than the originals are famously few — The Empire Strikes Back and The Godfather Part II are two of the more celebrated examples. For 2023, add Spain’s second €13bn 10 year Bonos syndication of the year to the list.

Being a consistent borrower in a volatile market is not easy. Spain had already syndicated a €13bn bond in January and it would go on to price three more syndicated deals, defying an uncertain rates backdrop, and taking size out of the market.

Replicating the success of a blow-out January deal five months later was a tricky task — but Spain excelled.

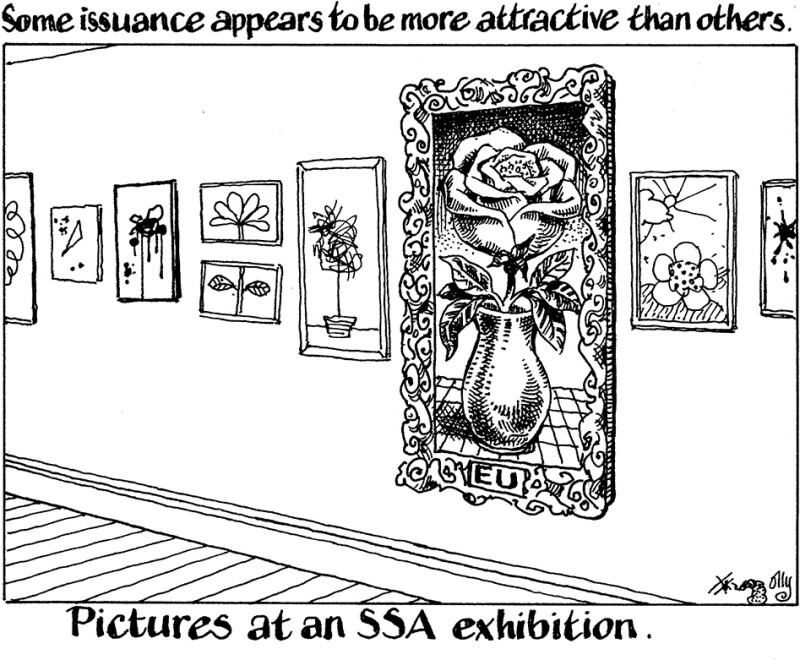

By the summer, the market was less liquid than it had been in January and, although yields were higher, the bond market was finding its feet after the spring banking crisis, while digesting quantitative tightening and the prospect of further interest rate increases. Despite pockets of fatigue appearing in parts of the SSA market at the time, Spain amassed an €85bn order book without compromising on the level it paid.

Non-syndicated Sovereign Bond of the Year

Italy

€18.2bn 3.25%/4% June 2027

Dealers: Intesa Sanpaolo and UniCredit

Co-dealers: Banca Akros and Banca Sella

We have taken the rare decision to make an award for the best non-syndicated sovereign bond of the year. No run of the mill auction, Italy’s first BTP Valore demonstrated the potential of retail investors, who may hold the key to eurozone governments’ funding after QE.

Retail bonds may not be a new idea — especially when it comes to Italy, with citizens already holding a chunk of its debt — but the launch of the BTP Valore, a new, retail-only product, in June was still an achievement. The BTP Valore differ from Italy’s other retail products, the BTP Italia, which are also available to institutional investors, and the pandemic-era BTP Futura.

Italy raised a stunning €18bn from the inaugural issue — two to four times market expectations. The second BTP Valore in October also beat expectations and raised the government €17bn.

Many sovereigns are yet to unleash the vast potential of their retail markets. Italy’s sale inspired others, including Belgium, which priced a jaw-dropping €22bn one-year, validating the depth of this funding pool as savers looked for an alternative to low paying bank deposits.

Big volume, lower funding and deal costs and investor diversification could make the retail market invaluable to sovereign issuers once they can no longer rely on the central bank to hold their debt.

Supranational Dollar Bond of the Year

European Investment Bank

$5bn 3.75% February 2033 Climate Awareness Bond

BNP Paribas, CIBC and Citi

The EIB set the tone for the dollar market in January 2023, kick-starting the year with a popular $5bn five year issue. It returned in February with another blow-out deal, this time in its Climate Awareness Bond format and in a longer, 10 year tenor.

It has not been easy to get duration in dollars in 2023 but the EIB defied that trend, pricing an impressive $5bn.

It remains the largest supranational green bond ever and attracted the largest book for a dollar 10 year print at $19.2bn.

It was a brave move, with the 10 year part of the dollar curve largely untested at the time: only one other supranational had attempted a deal in the maturity amid persistent interest rate volatility.

And for dessert? The EIB doubled up that week, pricing a €5bn 2.75% July 2028 Climate Awareness EARN off the back of the success of the dollar trade.

Both transactions meant the issuer had bitten off nearly half of its €45bn annual funding programme — and the year was only just getting started.

Supranational Euro Bond of the Year

European Union

€5bn 3.125% December 2030

Bank of America, Crédit Agricole, Morgan Stanley, Nomura and UniCredit

The European Union had a great run of deals in 2023 with 11 syndications across the curve, attracting huge levels of demand.

A €6bn reopening of its February 2048 green bond in March — a rare example of a successful long-dated trade — stood out by attracting €73bn of orders. Two months later it returned to take an eye-popping €9bn out of the market in one go. And the next month, it rode the positive momentum generated by its smaller than expected borrowing need for the second half of the year with another stellar sale.

But one deal showcased the EU’s skills as an issuer in the market above all: its €5bn seven year sale, priced in September. That might not look so special compared with a long-dated deal but the EU, like all SSA issuers at the time, was returning to a difficult market after the summer, in one of the busiest and most important months of the funding year. Demand had been so weak that even some of the biggest names in the market were struggling to ensure smooth execution.

The EU read the market and paid what was considered an “absolutely prudent” amount of premium for its deal to sail through, and without weighing down the market for follow-on issuers.

With this deal, the EU showed not just the important role it plays in the SSA bond market, but that it has the leadership to live up to its status.

Agency Euro Bond of the Year

KfW

€3bn 2.75% February 2033 green bond

Barclays, Crédit Agricole, DZ Bank and TD Securities

KfW has had a funding task over the past two years of €180bn, making it one of the most active SSA issuers. To meet its need, it had to mobilise in core and niche markets — and above all, make the most of its home market: euros.

The German policy bank kicked off 2023’s euro funding with a five year deal, raising an impressive €6bn from what was seen as a slightly unusual choice of tenor for early January.

With a good tone set, the issuer returned to euros in February with a 10 year green bond. The results were impressive, with huge demand from investors for the €3bn no-grow deal coming in at 11 times the deal size. That allowed KfW to price the bond with no new issue premium.

It was a deal that was crucial to KfW exceeding its €10bn green funding target in 2023, and also one that — together with many other excellent SSA ESG deals this year — demonstrated the robust demand for labelled bonds.

Agency Dollar Bond of the Year

KfW

$4bn 5.125% September 2025 and $2bn 4.75% October 2030

Bank of America, HSBC, JP Morgan and TD Securities

The year 2023 was all about issuer flexibility, their ability to identify the right issuance window across different markets, tenors and formats and their ability to pick the right execution tactics. Making it work in difficult conditions became the key challenge. KfW did just that, with its $6bn dual tranche transaction in October being a perfect example.

The German issuer had been quick to seize opportunities as the dollar market improved in 2023, returning to the 10 year part of the curve in July before taking $5bn in August. With a challenging euro market after the summer and a €90bn funding target to tackle, it spotted another chance — and this time took even more funding out of the market.

It was a new exercise for KfW: before October, it had never done two tranches in dollars at the same time. Add to that the inclusion of a tricky seven year maturity and the trade was not obviously easy to do. But the result was the largest dollar SSA transaction of 2023, despite the highly volatile backdrop.

It was a valuable lesson for the wider SSA market of the value of taking a flexible approach as a frequent borrower.

Sub-Sovereign Bond of the Year

State of North Rhine-Westphalia

€2bn 3.4% March 2073

BNP Paribas, Deutsche Bank, LBBW, Morgan Stanley and Nomura

Issuing long-dated bonds is rarely an easy task but it was even tougher in 2023 thanks to volatile interest rates and an inverted yield curve.

Land NRW bucked the trend. It was one of only two SSA issuers other than eurozone sovereigns and the European Union to print a 30 year bond in January – part of an impressive €5bn dual trancher when German states were raising less than €1bn on average from their deals.

In March, it went above and beyond in all senses, serving up the first and only ultra-long print from the public sector in 2023.

The German state managed to raise €2bn from what the market thought of as an “amazing” and “very special” 50 year trade that attracted €6bn of demand, with investors including central banks, insurers and pension funds drawn towards the 3.4% coupon.

Land NRW’s solid issuance history at the ultra-long end of the curve — including century bonds — has won it the biggest stamp of approval from investors. It was a type of success that no other issuer managed to replicate throughout 2023.

SSA Sterling Bond of the Year

European Investment Bank

£1bn 4.875% December 2030

Barclays, BMO and RBC Capital Markets

Sterling issuance had a rough start in the first half of 2023, when taking meaningful size and going out along the curve proved difficult. Only two deals away from the UK sovereign in the six months to June reached £1bn, with issuers focusing on shorter tenors, averaging 3.3 years with their benchmarks, according to GlobalCapital’s Primary Market Monitor.

But the EIB changed the game in July. It went to the longest point in the sterling curve year-to-date at that time, with the seven year deal more than twice covered and triggering a spate of trades from peers.

The deal reopened the market, with the likes of Asian Development Bank, KfW, Inter-American Development Bank and International Finance Corp subsequently appearing in the currency.

The EIB deal was the one that boosted morale and launched July towards becoming the busiest month in the currency since January, with eight syndications priced, while in the three months preceding the EIB deal there were just 10 sterling deals.

SSA ESG Bond of the Year

Cyprus

€1bn 4.125% April 2033 sustainable bond

Barclays, HSBC, JP Morgan, Morgan Stanley and Société Générale

Few deals seem to capture the imagination as much as one with which a sovereign embarks on its ESG finance journey — and Cyprus stole the show on that front in 2023.

The triple-B rated sovereign made its long-awaited ESG debut in April. It had been a busy few days for sovereign syndications, with Italy and Greece also in the market and Luxembourg and Slovenia pricing sustainability deals. Despite the competition, Cyprus’s 10 year was still a blow-out.

The sovereign received its largest ever book since returning to the international bond market in 2014 and managed to price flat to fair value — an outcome that beat expectations.

Even more impressive was the sovereign’s strategic planning and ESG ambition. Its ESG needs may be limited compared with its larger peers, but Cyprus is committed to maintaining a regular presence with a labelled issuance every two or three years. And it could not have kicked off this journey with a more remarkable inaugural trade.

Swiss Franc Bond of the Year

European Investment Bank

Sfr200m 1.46% July 2033

BNP Paribas

The most expensive, highest quality issuers were still too rich for the Swiss franc market, even after the Swiss National Bank raised its policy rate into positive territory for the first time in seven years in 2022.

But as rates rose around the world, Swiss franc issuance became possible this year for SSAs. The highlight of the rash of SSA deals this year in the minds of many was the EIB’s 10 year deal, priced in June.

The Sfr200m (€207m) bond was its first Swiss franc issuance since 2014. The deal was priced at 27bp through Saron — one of the tightest spreads the market had seen for a while. It was priced 3bp through 2023’s next tightest deal at that point — a five year from fellow triple-A rated supra, the Nordic Investment Bank.

Despite its negative spread, the EIB bond still offered an attractive pick-up to the Swiss government curve.

The spreads top-quality names were paying over govvies helped create investor appetite for exceptionally tight paper. The duration of the bond and the strength of the EIB’s name as an issuer also meant it was well received by investors, with orders coming in beyond the Sfr200m cap.

A bookrunner described the EIB as “one of the crown jewels”, and among the “best names you can find in the Swiss market”.

After an almost decade-long absence, its return demonstrated that the Swiss franc bond market was back as an attractive source of funding for even the richest SSA issuers.