Last week’s $1bn bond issue by Sasol, the South African chemicals and energy company, offered a telling case study in how the financial industry’s ambition to green itself bumps up against the reality of industrial fundraising.

Sasol, whose core activity is converting coal and natural gas into synthetic fuels, does not fit many investors' and some banks' aims to cut the greenhouse gas emissions they finance.

The issuer placed its bond but some investors stayed away, or ruled Sasol out of some portfolios. The eight banks that led the deal were dominated by US and Japanese firms — from Europe, only Standard Chartered and Intesa participated.

European banks — the most proactive about reducing fossil fuel funding — have been quietly leaving Sasol’s bank syndicate for years.

Sasol is just one of thousands of companies on the front line of the low carbon transition. But the episode points to several features of that transition in financial markets.

First: it is rough. Sasol will not relish being highlighted as a company with ESG challenges, especially as last year it published a climate change policy setting out how it plans to cut emissions. Other big polluters are more evasive about their plans, or do not have Sasol’s excuse of being a key energy source for a developing country.

But life is unfair — all change is bumpy. Financiers and industrial companies are going to take a lot of knocks on climate issues.

Second: the transition is opaque. Banks have been cutting clients on environmental grounds for at least 10 years, but they don't shout it from the rooftops. Even now it is difficult to get a clear sense of which banks would refuse a given issuer.

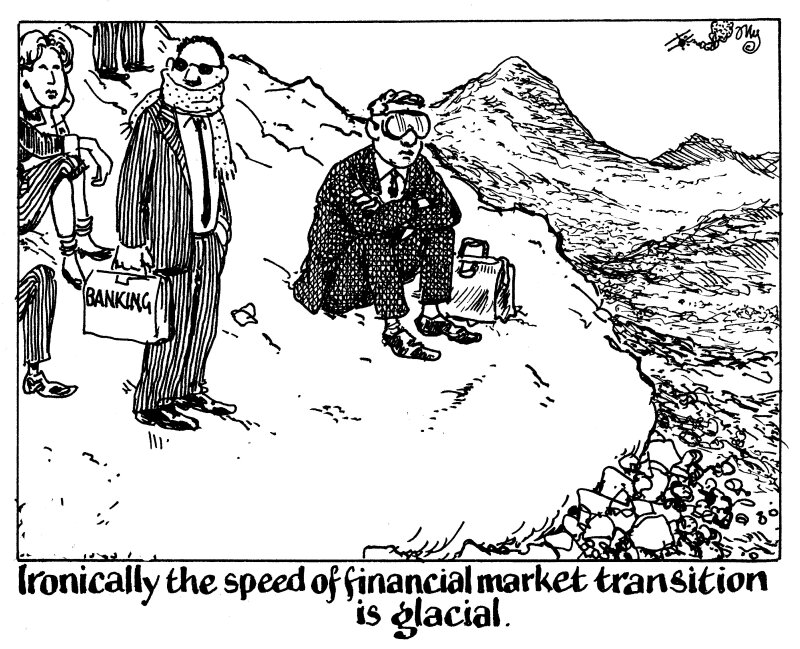

Third and most importantly, the transition is slow. Sasol had no problem hiring a syndicate including the three biggest US banks that drew $2.3bn of orders for its bond. Banks will also lend to it. At the margin, lenders pulling away from a company will raise its cost of capital but not necessarily by much.

In fact, if banks do pull away, it might just push Sasol to lower its leverage, making it a better credit risk.

Finance must push harder towards a green economy — but it is awfully good at saying one thing and doing another.