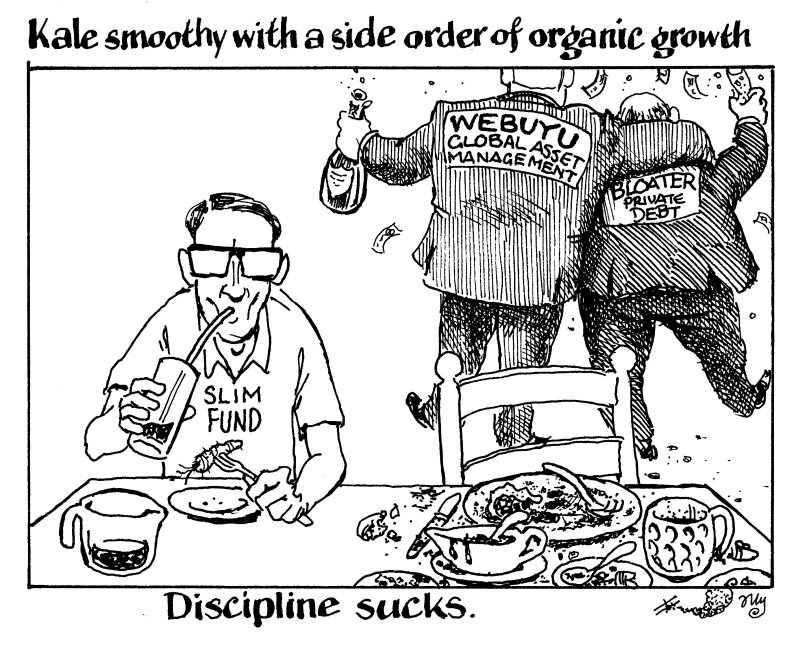

Discipline is everything in private debt fundraising, or so we were told.

Fund managers have struggled to raise commitments from investors (LPs) in recent months because of the so-called denominator effect, where plummeting asset prices in public markets have raised the portion of portfolios invested in private to towards their limits.

But there was a time — before Russia’s invasion of Ukraine a year ago — when LPs were piling into private credit funds. Some managers sensed an opportunity to move further up the food chain.

Ardian held a €5bn final close for its fifth flagship private debt fund last year, representing a 67% increase on the €3bn raised for its predecessor.

Similarly, Pemberton’s third European mid-market fund reportedly has a target of $4.5bn-$5bn. Its second fund closed at €3.2bn, against a target of €2.5bn.

Other managers have stuck more firmly to their historical remits. Eurazeo is targeting €2bn for its sixth direct lending fund, a more modest uplift on the €1.5bn raised for its fifth fund.

Muzinich also sought a modest uplift for its second fund, with €800m raised — compared with the €706.5m raised by its predecessor.

In these cases, and some similar ones, investors are said to have been encouraged by the discipline managers showed in not taking on every last penny waved at them just to run larger funds.

But the asset class has not become unattractive. Despite what is expected to be a temporary pause in fundraising, asset managers and large private equity firms are actively looking to buy into the market, as GlobalCapital has explored this week.

TPG Capital CEO Jon Winkelried recently revealed the firm is pursuing inorganic growth as a priority and is “actively focused on expanding into corporate credit”.

Yet there are questions as to how many potential targets there may be that would be of a suitable scale for PE behemoths such as TPG, and indeed for global asset managers.

That means there is a bigger bid out there for those that went wild while fundraising. So, when it comes to founder exits, it may transpire that firms that have adopted more opportunist approaches will be rewarded more readily than those that kept their discipline.