Europe’s high grade corporate bond market has become one of two tiers, with top rated multinationals having a much easier ride when it comes to issuance than cyclical, domestically focused companies.

While this may be tough for the second group, it is indicative of a market finally being allowed to function properly.

Since the rush of deals in the autumn restart began, the market has been one of haves and have-less. Those issuers in the elite tier with a high rating and revenues drawn from many markets have been able to print multiple tranches with longer maturities and with smaller new issue concessions.

Siemens, Danone and Orsted have demonstrated this in the past few weeks across euros and sterling.

Those more reliant on domestic markets for income, or that operate in cyclical industries, have had to settle for shorter maturities.

This week, outside of Orsted and SSA crossover name La Poste, every trade has been in the four to six year maturity bracket. All things being equal, issuers prefer to go longer with their euro trades to put off refinancing risk for as long as possible.

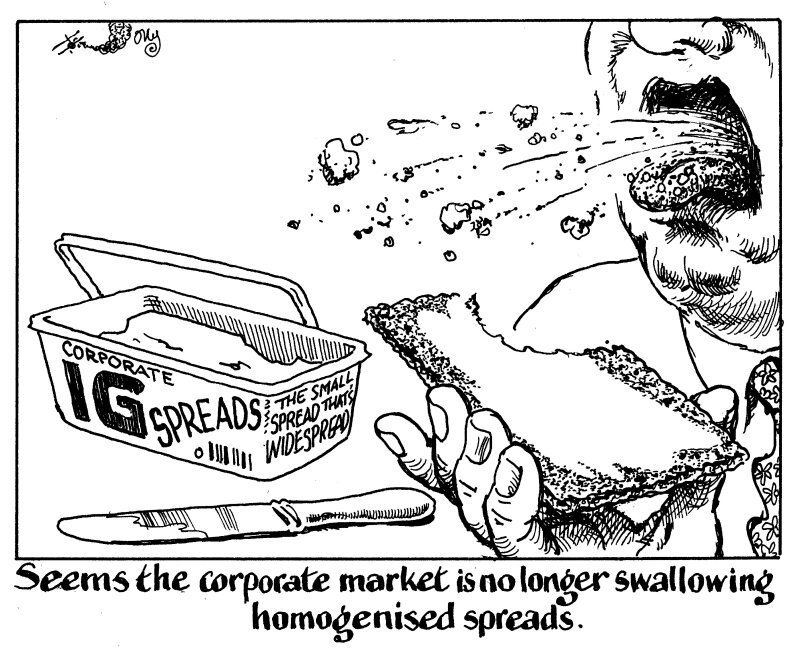

For anyone that has joined this market in the past 10 years, this must be something of a shock. Since the fallout from the global financial crisis in 2008, various central bank bond buying programmes have homogenised spreads in investment grade credit, pushing everything tighter. Riskier credits benefited the most.

The fact that this is vanishing is a good thing. Investing is all about assessing risk and, with central banks buying so much of the market, there has been little to assess.

Now, investors will be rewarded for the extra level of risk they are taking on for the lesser loved businesses.

A two tier market is just the beginning. The market will really be working when investors distinguish between the full spectrum of risk that existed in the days before quantitative easing. It will be a welcome return to complexity and discernment.