Sustainability is by no means a novelty in the well-heeled corners of capital markets, but the world of leveraged finance is still getting to grips with the concept. This year, over €20bn of sustainability-linked notes has been issued in the high yield and leveraged loan markets — almost eight times the amount issued through the whole of 2020.

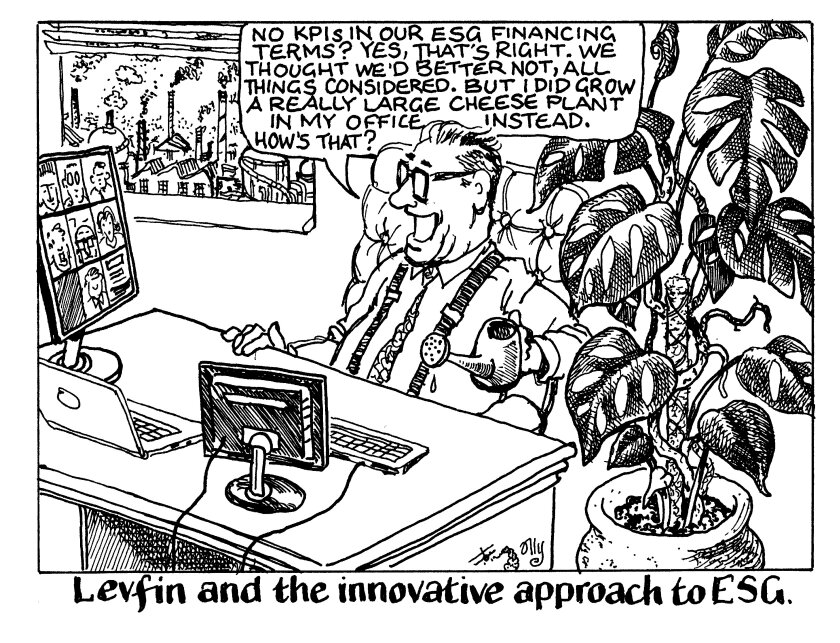

For several years, concerns over pushing the limits on what investors find palatable have abounded, with borrowers accused, for example, of greenwashing — dressing deals up to look greener than they really are.

In the syndicated loan market, there was uproar when certain banks allowed companies to sign sustainability-linked loans before coming up with the key performance indicators that would govern margin payments.

There was consternation in 2019 when Marfrig, the Brazilian beef producer, managed to sell sustainable bonds. Now, sustainability as a concept is headed for a market where some might say pushing investors to their limits is a feature, not a bug.

One of the first whiffs of creativity wafted across the market this week when waste recycling firm Itelyum issued a €450m sustainability-linked bond. Instead of the ESG margins being tied to the interest payments, Itelyum’s deal had two 30bp step-up ratchets linked to the bonds’ redemption. This is a much more attractive deal for the borrower. Itelyum can choose when the KPIs are triggered, and only trigger them once at redemption.

That is the first salvo from a market where the sell-side has been running riot in ripping up investor protections for years. It is surely just the start of any other number of innovations that purport to help save the planet and improve society, while handily making life easier for the borrower.

Investors, especially those with a strict ESG mandate, will need to pay close attention to what they are asked to buy.