UK shareholders have been unsung heroes of the country’s recovery from the depths of the coronavirus pandemic. They have stepped in to support businesses through a period of unprecedented disruption by participating in equity raises.

To do so required considerable nerve. To support a capital raising, equity investors need a clear idea on a company’s near-term revenue prospects.

Bankers will remember how difficult capital raising was in March and April, when the length and severity of the pandemic were complete unknowns.

As companies work through from the early phase of the pandemic to the middle — and begin to hope for an end — there is still a lot of capital raising to be done.

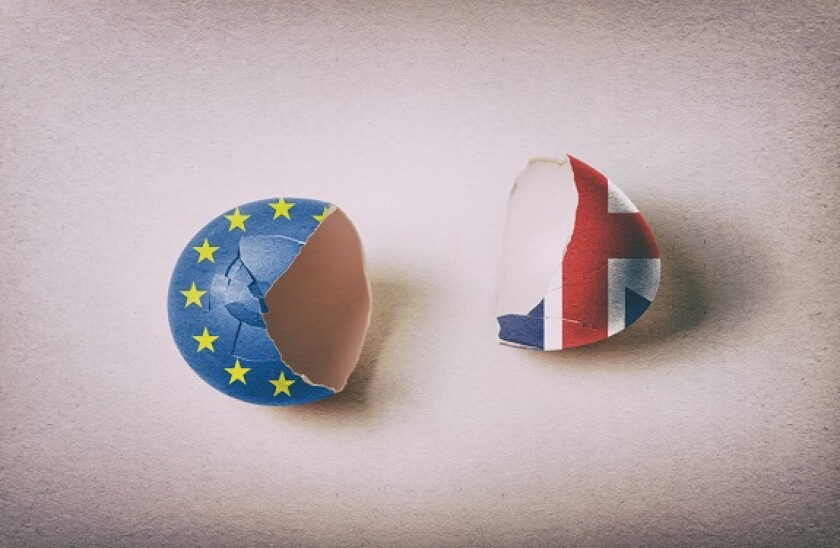

The problem is, just as we begin to emerge from the fog of Covid, the threat of a No Deal Brexit has blown in a new pall.

If the Brexit transition period ends without a deal on December 31, any UK company that trades with Europe will be forced to go to shareholders knowing that its revenues are likely to be hit severely. It will not know the extent of that hit or how long it may last.

Although there has been some talk among equity strategists that the UK government’s deal with Europe will probably be so unambitious that it is barely different from No Deal, a thin deal would at least lead to a period of continental co-operation. It could ease the transition and even provide a springboard to something more ambitious.

There are even lobbying efforts under way to persuade MPs and the public that the UK should rejoin the European Free Trade Association and European Economic Area after Brexit. That could bring a return to frictionless trade.

However, under a bad-tempered No Deal exit, UK businesses will be wrenched away from their most important external markets at a tumultuous time.

They will have no idea of the long-term costs or whether seamless trade links can ever be restored. There is also likely to be maximum disruption, as EU states and the UK blame each other for the breakdown in talks.

Having got through the first part of the crisis — and stepped up to the plate — equity investors should now be preparing to support companies through the pandemic's recovery phase.

If the country plunges into a Brexit blackout, there are severe doubts as to whether investors will have the UK's back again.