There is no doubt that the Asian bond market has enjoyed a bumper start to 2007. The volume of new bonds issued in any currency across non-Japan Asia in the first quarter jumped by 10% compared to the same period in 2006, hitting $70 billion in the first three months. Bonds issued in dollars, euros and yen accounted for $31.7 billion of that total, according to data firm Dealogic, again up 14% on last year.

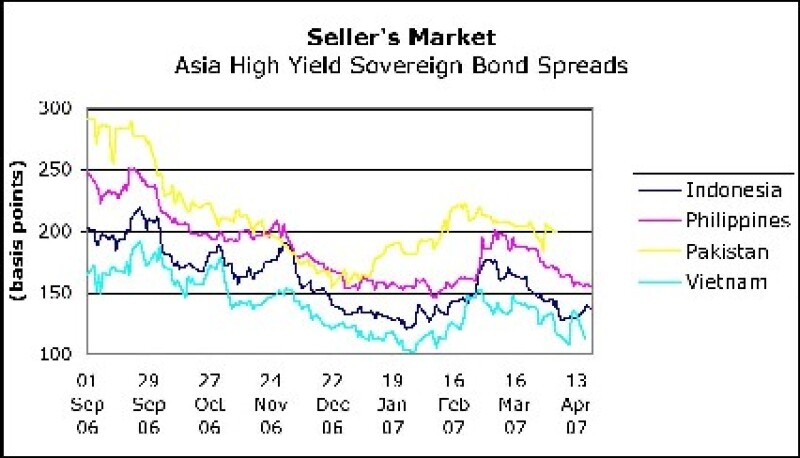

Regular borrowers were quick to take advantage of record tight credit spreads in the early part of the year (see chart), with Indonesia and the Philippines, as well as Korea’s two largest state-owned policy banks, launching new benchmarks. And this year’s numbers have been given a welcome boost by a surge in business in India, where bonds worth a record $5.8 billion were launched in the first quarter. But the rise in volume has been concentrated in the financial sector, and fund managers who rely on higher yielding bonds to generate returns have been frustrated by a lack of new deals.

Investors are facing the prospect of falling supply from the Philippines and Indonesia, where economic growth has seen investments in sovereign bonds perform strongly in recent years. Both countries have cut their international funding requirements this year, and are unlikely to return to the international markets before 2008 after successfully launching new bonds in January and February. And by April 13 only two non-investment grade borrowers – GITI Tire, a Singapore-Indonesian owned tyre maker, and Hong Kong-listed property company Lai Fung – had issued debt in the international capital markets since last December.

“The start to 2007 has been relatively disappointing,” says Vinay Jayaram, head of Asia debt syndicate at Morgan Stanley in Hong Kong. “Banks will always need to finance, but the market should be on a secular increase, and this has not been the case.”

Jayaram attributes the disappointment to a relative lack of new issues from corporate borrowers able to take advantage of favourable lending terms from Asian – and international – banks. But there may be a less obvious reason that has more to do with cultural characteristics than market liquidity. “The shareholder activism that is a real feature of the European and US markets is not so prevalent in Asia,” argues Jayaram, noting that the recent wave of leveraged buy-outs shows that Australia has overcome this hurdle. “Many companies are still family-owned and very conservatively run, and that will have to change before we see leverage ratios increase.”

Other bankers share this sense of disappointment, but argue that a large number of companies are planning bond issues later in the year. “Given that the credit markets are very strong, and that there are some worries over economic signals in the US that could affect the latter part of the year, I would have expected a busier start to the year,” says Stephen Williams, co-head of global capital markets Asia Pacific at HSBC in Hong Kong. “There has certainly not been as much high-yield issuance as we had expected. There was a surge in the fourth quarter of 2006, and it is taking a while for deals in the pipeline to reach the market, but I expect to see the fruits of this in the next few months.”

Jon Pratt, head of debt capital markets for Asia Pacific at Merrill Lynch in Hong Kong, also expects the flow of high-yield deals to gather pace later in the year. “The corporate loan markets across Asia are very liquid, and terms are attractive for borrowers, and that is definitely a factor,” he says. “But I expect the high-yield bond market to pick up towards the middle and end of this year, once companies have taken the time to properly prepare for a deal.”

Local markets grow

Asia’s domestic currency bond markets are keeping pace with the region’s impressive economic growth, becoming a real alternative to the thin international markets for borrowers and investors alike.(For a detailed look at Asia- a decade after the crisis see Asia crisis, 10 years on)

“The domestic bond markets have been very active this year, with around $29 billion issued so far in Asia outside of Japan and Australia,” says Aamir Rahim, head of fixed income capital markets for Asia at Citigroup. “A lot of corporate issuers are looking at local currency bonds to fund domestic growth, taking advantage of the growing local investor base and an increasing influx of international investors to Asia’s local bond markets. Local issuance also offers a natural asset/liability hedge for most Asian companies, given that the majority of their assets are in local currency.”

International investors bought local Vietnamese bonds for the first time last year, when state-owned electric utility EVN placed most of its 10-year dong bonds overseas. Vinashin, the state-owned shipbuilder, followed suit with its own 10-year deal in March.

Growing liquidity has also tempted international issuers to tap the Singapore dollar and Thai baht markets for funding. “It is impossible to generalize across the local currency markets, and no single country is dominating the region,” says HSBC’s Williams. “But there is a lot going on, and the domestic bond markets in countries such as Malaysia and India have been especially active.”

Banks dominate

But, even including Asia’s manifold local markets, Dealogic data show that private companies accounted for just 26% of all bonds issued in Asia outside of Japan and Australia in 2006. That was down from 46% in the same region in 2003, and 32% in 2005.

As a result financial institutions have become the dominant issuers in the Asian debt capital markets. “The Asian market has always been dominated by sovereign and financial institution borrowers,” says Rahim at Citigroup. “What we are seeing, however, is a shift from public to private banks, with more private-sector lenders such as Bank of India, ICICI and Maybank raising money on the international markets.”

ICICI Bank, India’s largest privately-owned financial institution, stunned the debt markets in January when it issued $2 billion of bonds in what is by far the largest international deal ever launched by an Indian borrower.

Pratt accepts that Asian financial institutions have become the region’s dominant issuers, but he does not see this as a negative development. “The growing importance of banks in the market is a natural phenomenon, driven by rising loan activity and economic growth across Asia,” says Pratt. “One of the more marked recent trends in the Asian debt capital markets is the emergence of Indian banks as frequent borrowers, which reflects the growth of the Indian economy, as banks are borrowing to fund their customers’ expansion plans or acquisition activities, and this is a relatively new driver of business.”

Going private

While Indian issuers are a welcome addition to the Asian market, they do not offer the high coupons that many emerging markets investors have come to expect.

This lack of high-yield opportunities is driving yields tighter as investors compete for bonds, in turn fuelling the development of a private bond market, where companies typically place unrated debt with one or a handful of funds.

“Asia’s private bond market is very well developed, and this has been quite active in the early part of 2007,” says Pratt at Merrill. “This has grown as investors are prepared to invest larger sums and are looking for more significant allocations than they can get in the public markets.”

Critics are quick to point out that the private market is a riskier prospect for debt investors, where bonds come with little or no liquidity, and issuers at the high-yield end of the credit spectrum are typically unrated. Nonetheless, the number of funds targeting Asian debt continues to grow at a much faster pace than the supply of deals in the public markets, leaving investors with little option but to consider the private market.

“There is a lot of sophisticated money coming into Asia,” says Pratt. “Hedge funds are arriving in Asia in force, and a large portion of the new money is going into private deals in Indonesia, China and everywhere in between.”

Bankers estimate the private bond market to be worth between $5 billion and $7 billion a year, comprising a growing number of small transactions. “The private bond market has grown rapidly over the last 18 months, but borrowers that are able to access the public markets are not necessarily looking at private deals,” says Williams at HSBC. “Deal sizes are still small, typically well under $100 million, and only very few investors have the ability to play in this market. It is a new market that is growing in its own right, rather than cannibalizing the public business.”

Rahim at Citigroup agrees, but emphasizes that this market will not solve the imbalance between supply and demand. “The private bond market has grown over the last year, but it has not cannibalized the public markets to any great degree,” he says. “Even in this market, there is still a shortage of supply, with too many investors chasing too few deals.”

A new hope

With demand for emerging markets assets higher than ever, bankers are beginning to explore new jurisdictions. Adds Rahim: “Although deal volumes in some countries are falling as governments scale back their borrowings, there are new markets coming on line, including Pakistan and Vietnam, while the big story of this year has been India. Logic suggests that the Indian subcontinent will continue to be busy for the rest of the year.”

The Islamic Republic of Pakistan has mandated Citigroup, Deutsche Bank and HSBC to arrange its next sovereign bond issue, and bankers are also pitching for mandates from both private and state-owned companies, on the back of a successful deal late last year. Pakistan Mobile Communications, or Mobilink, issued the first international high-yield bond from the country in November 2006, with a very popular $250 million, seven-year issue arranged by ABN Amro and Deutsche Bank.

Vietnam has long been rumoured to be planning a repeat of its maiden international bond, which raised $750 million in 2005. Other emerging economies such as Bangladesh and Cambodia are hearing early pitches from banks, and Citigroup and ING are sitting on a debut sovereign bond mandate from Mongolia.

With bonds from the more established issuers in such short supply, they cannot come soon enough.