Robin Phillips, HSBC’s head of global banking and markets for Asia Pacific, smiles ruefully when Asiamoney describes the bank’s investment banking strategy of the past 20 years as having been evolving.

“Evolving is a nice way of putting it. One that’s had its ups and downs is another way of looking at it,” he says.

HSBC has been notorious for its inability to succeed in equities and investment banking ever since it bought UK brokerage James Capel in 1986, only to squander its legacy.

The bank has tried several times, typically hiring a set of expensive investment bankers, only to let them all go when the deal flow fails to materialise.

But over the past 18 months this has changed. HSBC’s name has been included in an increasing number of equity capital markets (ECM) and M&A deals, particularly in Asia.

It’s far from being a truly regional player, but it doesn’t want to be. Instead HSBC is building itself a track record in a few specific areas, principally its home market of Hong Kong. Its success here is causing people to take notice.

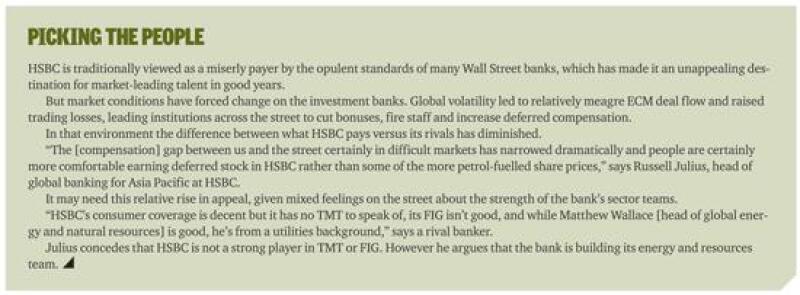

“Among the second-tier players in equities and ECM HSBC has done the most to improve over the past couple of years,” says a veteran headhunter in the region. “Its business is doing fairly well, and it has picked up market share. It’s no longer a bank that you’d be embarrassed to mention to your clients.”

Yet HSBC’s success so far also points to a weakness: it has little breadth outside Hong Kong.

The bank could particularly do with snaring some truly top draw deals from China. That would best underline its improving capabilities to the market at large.

Three-year plan

HSBC’s struggles to make a fist of it in ECM are famous in investment banking circles.

The bank most famously attempted to establish itself in global capital markets in 2003, when it hired John Studzinski, formerly Morgan Stanley’s head of Europe, to be co-head of corporate and investment banking alongside Stuart Gulliver.

A set of costly hires followed but the deal flow didn’t, and the relationship of the two ambitious co-heads soured amid personal and stylistic differences. Studzinski eventually quit in June 2006, and many of the bank’s expensively assembled staff left too. HSBC subsided back into investment banking limbo for several years.

Phillips, who relocated to Hong Kong in October after co-heading global banking in London, says HSBC decided once again to improve its investment banking and equities businesses at the behest of Gulliver, who is now HSBC’s chief executive.

“Stuart Gulliver, Samir Assaf [head of global banking and markets] and myself said that we could and should be doing better in the equities business,” Phillips says. “So [we decided] ‘let’s do it, but in a way that is measurable, achievable and is in tune with where our strengths lie’.’”

The group CEO’s name continually crops up in conversations with HSBC’s senior staff. He is described as smart, forceful and driven.

Back in 2009 Gulliver was widely tipped to become the next group CEO after Michael Geoghegan, something that became official in September 2010. He has long advocated HSBC using its corporate banking relationships to build investment banking.

This especially applies to Asia, where HSBC is one of the largest treasury and cash management providers, a huge corporate bank, a leading regional lender and possesses one of the largest wealth management operations.

“Stuart would say ‘we’d never set up a pure investment bank but it’s an extremely important part of an overall investment banking strategy,’” adds Phillips. “Obviously 10 years ago that wasn’t the case.”

Indeed, even in 2009 the bank was punching well under its weight. It ranked 14th for completed M&A advisory work in 2009, having been responsible for US$8.89 billion of deal flow, while it was a lowly 31st in Asia ECM the same year, recording a paltry US$1.04 billion of volumes, according to Dealogic.

Home advantage

Gulliver installed a simple strategy to fix this: doing very well in a few core markets.

“The simple philosophy was that in any business or industry you cannot be well regarded globally unless you’re good in your home markets,” says Russell Julius, HSBC’s head of global banking for Asia Pacific. “In this part of the world that would be Hong Kong, and India to a lesser extent.”

The former makes sense. For a start it’s HSBC’s original home – “as Stuart says, the clue is in the name,” says Gordon French, head of Asia Pacific global markets for HSBC.

“If you look at the South China Morning Post what is the product area most visible to the [Hong Kong] business community? It’s equities. It’s large IPOs,” adds Phillips. “No brand will succeed or fail on [your ability to arrange equity issues] but it will be influenced in this market by our ability to have a fair share of that business.”

Additionally, Hong Kong was the world’s busiest listing market last year, accounting for US$36.07 billion in new listings, according to data provider Dealogic. And China and Hong Kong together raised US$2.9 billion of ECM fees in 2011, or 76.2% of overall region’s total.

“About 60% of fees come from China, a lot of which is from equity deals that are priced in Hong Kong,” says a bank observer. “If HSBC is good at those it doesn’t have to be first-rate in India or Southeast Asia.”

Within Hong Kong HSBC wants to be top five for ECM and equities.

To achieve that it has restructured its equities business. The division was once separated from the rest of global markets, which meant it lacked influence with senior management or access to HSBC’s otherwise strong corporate relationships.

“We were asked by Stuart and Samir to take ownership of equities and treat it as we would any other business, particularly successful businesses such as FX, rates, credit and DCM,” French tells Asiamoney.

Combining equities with global markets seems obvious, but French says “it took Gulliver and his force of character”.

Over the past two and a half years Rakesh Patel, HSBC’s head of equities who observers describe as a “good guy and decent manager”, has focused on building a team with a firm focus on Hong Kong. The salespeople and traders now sit with the rest of the global markets team.

“Previously we tried to do American stocks and investment banking,” says Patel. “But that doesn’t play to our strengths at all. We should be focusing on emerging markets.”

The restructuring seems to be working. HSBC was voted the fifth-best brokerage for sales and research in the region in Asiamoney’s Brokers Poll last year, having not polled anywhere the year before.

It is now rolling out a prime services platform that it spent the last year putting together.

“Prime broking is front and centre for us as it’s a new build and we have a special opportunity,” says French. “In most other parts of the business we’ve already built critical mass.”

“You can go from a 5% wallet [share] to a 25% wallet with prime,” adds Patel. “So it’s critical to get it right.”

Quid pro quo

At the same time HSBC has offered key clients more loans. This was in direct response to the actions of arch-rival Standard Chartered.

“Three to five years ago we noticed Standard Chartered took a different view [to us] and [began] taking very large positions in certain markets around the region to catch up,” Julius says. “And we decided that while we have to continue to be a bank to a large number of clients we also have to be a significant bank to those customers where we wanted to get a large share of their wallet.”

HSBC has a loan book of “about US$70 billion” in global banking, which it may expand. Key clients can access to this but in return are expected to make HSBC a bookrunner or adviser on capital markets deals.

“We’ve started by focusing on our core client base, the largest Hong Kong clients who’ve banked with us since they were young men,” Julius says. “HSBC was an early financier of [Cheung Kong Holdings and Hutchison Whampoa chairman] Li Ka-Shing for example. You could see the success of that strategy last year.”

By this he means HSBC was a bookrunner on HKT Trust’s HK$9.3 billion (US$1.19 billion) IPO in November. It is a telecom vehicle spun out from PCCW, the company owned by Richard Li, son of Li Ka-Shing. Plus HSBC was a bookrunner in the Rmb10.48 billion (US$1.61 billion) listing of Hui Xian Reit, a joint-venture of Cheung Kong, in April 2011.

It benefited on the M&A side too, purchasing Cambridge Water from Cheung Kong Infrastructure (CKI) in the UK for £74.8 million (US$122.3 million) in August. This freed CKI to buy Northumbrian Water for US$7.56 billion, which was partly funded by HSBC. The bank subsequently sold Cambridge Water to Alinda Partners for US$95.59 million in October.

HSBC is also lending less to corporates that don’t give it mandates. While Julius refuses to name companies he notes that “there was one client that we have a billion dollars exposure [to] but they gave a placing mandate to a US bulge bracket bank…[and] the amount of money we earned on our US$1 billion balance sheet exposure was the equal to the amount that the firm earned overnight on the placing. That’s not going to happen again.”

Improving presence

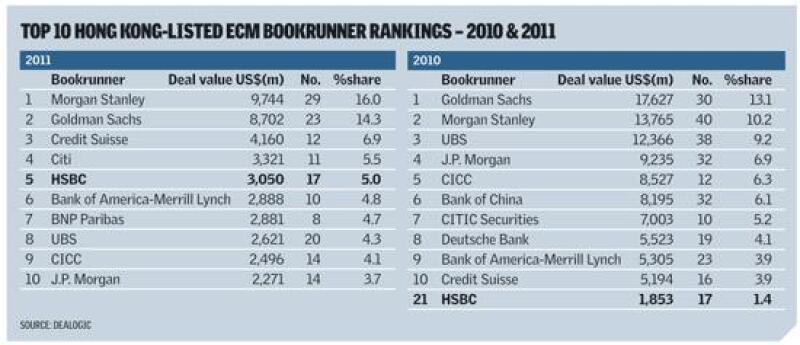

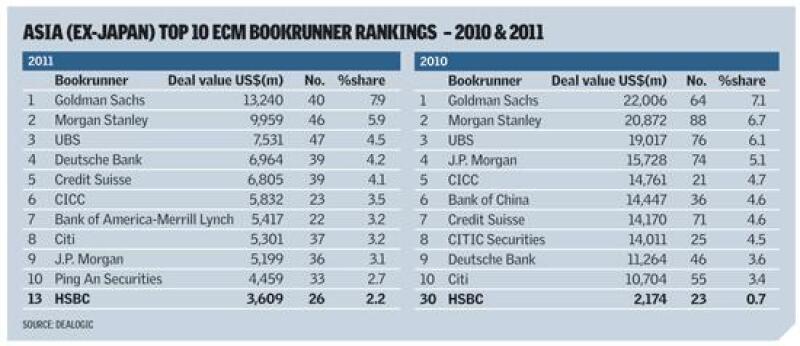

The give-and-take strategy seems to be working. Last year HSBC ranked 13th in the Asia ex-Japan ECM league table rankings, having participated in 26 transactions that raised US$3.61 billion. That compares to US$2.17 billion via 23 deals in 2010, when the bank was 30th for ECM.

More pertinently HSBC ranked fifth for Hong Kong listings with US$3.05 billion of deal flow last year, versus coming 21st via US$1.85 billion in 2010.

A standout deal in 2011 was its bookrunner role on Sun Art’s HK$9.47 billion listing, which Asiamoney named IPO of the year in 2011.

HSBC is also making ground in M&A. It was the 11th-most prolific bank for completed M&A in Asia last year, having advised on 31 deals worth US$17.96 billion; much better than its US$8.89 billion worth of M&A in 2009.

The bank ECM and equities efforts in Asia and Europe are having an impact on its bottom line.

HSBC released its 2011 annual results on February 27, in which it revealed that Global Markets business profits slipped from US$9.17 billion in 2010 to US$8.1 billion last year. But income from equities within the division rose from US$755 million to US$961 million.

Additionally, HSBC’s financing and equity capital markets division, which is part of global banking, saw profits rise 13.3% to US$3.23 billion last year. The bank explicitly pointed to a rise in Hong Kong IPOs when explaining this increase.

China conundrum

But it was not all good news. While HSBC pointed out in its annual report that “Revenues in the advisory business within financing and equity capital markets increased, notably in Europe, driven by success in cross-border transactions,” it made no mention of Asia.

A headhunter adds that that HSBC’s boast about matching corporate and investment banking sometimes ring hollow.

“HSBC tells its bankers that it has balance sheet and can lend, but frequently it won’t. Other banks such as Citi do a better job getting the corporate bank to support investment banking,” he says.

In fairness it’s still relatively early days for this strategy. Of bigger concern is HSBC’s virtual absence in mainland China. The bank was 22nd for ECM and a woeful 51st for completed M&A in the country in 2011.

Some observers contend that HSBC’s China team has been expensively assembled, but lacks standout bankers. Julius disagrees.

“We hired Jane Wang from Lehman Nomura [as chairman of China coverage and head of corporate finance in November 2010] and she’s been effective for us in a number of deals and we have a good [China] CEO [called Helen Wong] too,” he says.

Julius adds that HSBC’s ability to get deals is diminished by it possessing stakes in Bank of Communications, Ping An Insurance, Bank of Shanghai and Industrial Bank, which conflict it out of most financial institution transactions.

“I wouldn’t have thought Bank of China would have us at the top of the list as an underwriter for an equity issue,” he says.

Julius doesn’t disagree with the point that HSBC has yet to be employed on a true benchmark transaction from China. However he hopes this will change this year, when some potentially “franchise defining” IPOs such as deals for Chinalco, the People’s Insurance Company of China and Citic emerge.

“We are very focused; we have our elephant list which we are looking at very closely,” he says.

Even so, HSBC could do with an onshore securities joint venture to underline its credentials as a serious candidate for deals from mainland Chinese companies. But there are few signs that it will sign up to one any time soon; insiders blame a lack of strong available partners.

The bank is also a bit light in India, which is concerning given that it’s meant to be a core market. HSBC was sixth for Indian listings in a weak year for ECM in 2011, with its participation in Tata Steel’s INR34.77 billion (US$753.4 million) follow-on offering the highlight.

It’s a tough country. The government offers no fees for privatisations and corporates squeeze margins too. But HSBC wants to do well there, so it has been willing to do deals for less money than it would normally accept.

“We decided that we wanted to be a league table player and establish our credibility so we made a push to participate in a number of government-related deals,” says Julius. “On a fully costed basis, they lose money. But we have a number of good [corporate] relationships there too so we make a bit of money in India.”

Hong Kong commitment

Viewed from a regional perspective, HSBC remains a distinctly middle-tier bank in ECM and M&A. But within its limited geographic focus the bank is making progress.

However even in Hong Kong HSBC should really aim higher. Fifth for ECM isn’t bad, but it should really be first or second.

Julius is adamant that in Hong Kong at least he won’t pay for league table ranking – “I don’t need to be the number one in block trades and make very little money in order to be credible,” he says. But the bank seems aware that it needs to step up further.

“We’ve seen significant improvement, both in our ECM and M&A businesses in 2011 for Hong Kong China,” says Phillips. “What we need to do in 2012 is to consolidate and improve that position.”

It should do more than that. If HSBC is genuine about possessing an emerging market focus it needs to develop deeper equities and investment banking in mainland China and India.

That promises to be a far more difficult endeavour.