Americas

-

EM specialist firm Exotix has hired a well-known corporate credit analyst to lead its coverage of Latin American companies from New York.

-

Chinese biotech firm Zai Lab has launched bookbuilding for a $105.9m IPO of American Depository Shares (ADS), and is counting on US investors favouring start-ups to support the deal.

-

Zai Lab is set to kick off roadshows on Tuesday for its $150m IPO on the Nasdaq, according to a banker leading the transaction.

-

Two Latin American companies announced roadshows this week as the new issue markets finally gave an indication that banker predictions of a hectic September could come true.

-

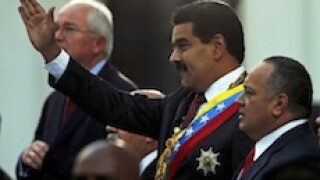

Prices in Venezuela and PDVSA bonds remained stable in the secondary markets this week, despite US sanctions on new debt issuance, as bondholders appear none the wiser as to the next step in the country’s economic crisis.

-

Brazilian mining giant Vale is looking to make the most of a better than expected cash position to redeem its 5.625% 2019s and buy back 4.625% 2020s through a tender offer.

-

A record-breaking month of high-grade dollar bond supply fizzled out as Hurricane Harvey, North Korea and the holiday season kept a firm lid on issuance.

-

Fitch downgraded Venezuela by three notches on Wednesday, saying that the imposition of US government sanctions on the country further reduced its financing options.

-

Best, a logistics firm backed by Alibaba, started pre-marketing its $1bn IPO on the New York Stock Exchange this week, as a clutch of Chinese issuers also filed listing applications in the US.

-

ING has reshuffled its line-up of syndicated finance bankers, creating a new European regional head role while relocating its global head from London.

-

Europe's corporate bond market was firing on all cylinders on Wednesday. Three issuers launched deals, while others continue to fill up next week’s issuance pipeline.

-

Peruvian plastic packaging company San Miguel Industrias is looking to issue new debt to refinance its only existing international bonds, which mature in 2020.