Americas

-

Crisis-hit countries that go through a painful debt restructuring programme as part of a bailout enjoy much steeper cuts in their medium-term debt, according to an independent analysis of International Monetary Fund rescue programmes.

-

The fourth quarter began on a rocky note for global equities but the US high grade bond market has shrugged off concerns about stalling growth and issuance conditions remain strong.

-

For Canadian pension fund CDPQ, direct investments in private equity have become a crucial part of portfolio management. As the political debate around PE firms heats up globally, the Quebec pensioners are enjoying the fruits of CDPQ’s foray into the risky, demanding asset class that is off-limits for many smaller pension funds.

-

Three Chinese companies joined the queue to list in the US within the past week. Youdao, an online education platform founded by Chinese technology company NetEase, is planning the largest of the IPOs, seeking up to $300m.

-

Brazilian ECM has surged this year, thanks to a belief in president Jair Bolsonaro’s plans for the economy. Brazilian corporates have taken advantage of investor excitement to raise more than $15.4bn in equity financing over the first three quarters of 2019. But this could be just the start, with a wave of privatisation also possible.

-

Hong Kong SAR’s equity capital market has come back to life recently with a handful of well-received IPOs. A further boost is also likely if the US goes ahead with its threat of banning Chinese listings on its exchanges, writes Jonathan Breen.

-

Credit Suisse has found one way to deal with low interest rates in Europe: switch into another currency. The Swiss bank has conjured up an extra Sfr250m ($250m) of net interest income (NII) per year from changing how it hedges the capital to meet its operational risk.

-

Contrary to growing fears of an impending recession, Fisch Asset Management believes that the global economy is in a “Goldilocks” period and recession is a distant prospect. But as a result, Fisch believes the SSA market is in “one of the biggest bubbles” it has experienced and faces a “quick and strong” correction.

-

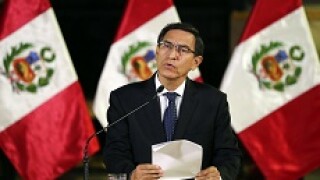

Latin America equity and bond investors have been left to consider the cost of political volatility in Peru, after the relationship between the country’s president Martín Vizcarra and its congress completely broke down on Monday.

-

Youdao, an online education platform founded by Chinese technology giant NetEase, is planning an IPO of American Depository Shares (ADS), having filed a draft prospectus with the US regulator.

-

Promigas, the Colombian natural gas distribution company, is hitting the road with a debut senior unsecured dollar bond offering.

-

Delta, the US airline, announced last week that it had struck a deal with LATAM, the largest airline in Latin America, in a deal which it expects to finance in the bond market.