AfDB

-

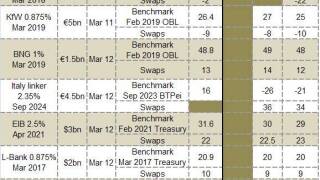

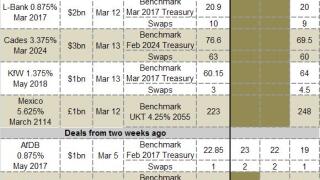

This week's scorecard focuses on the funding programmes of some of the major supranational borrowers, with the IADB's $2bn benchmark on Wednesday helping it near the halfway mark for the year.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week's scorecard focuses on the funding programmes of some of the major supranational borrowers, with the World Bank having completed 90% of its target volume for its fiscal year.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The African Development Bank, Caisse des Dépôts et Consignations and the Bank of England mandated banks for three year dollar benchmarks on Tuesday. The AfDB and CDC deals are likely to come this week.

-

The European Investment Bank has set a new precedent for the growing green bond sector, tapping an existing deal to make the largest outstanding volume of any green bond to date. But the prospect of these bonds pricing through normal bonds’ secondary curve still looks some way off.

-

The growing popularity of green bonds helped the African Development Bank access the Nordic capital markets for the first time this week — and the issuer is confident that more deals in the region could follow.

-

World Bank is set to sell a new five year Kauri bond on Wednesday, building on a good start to the year for New Zealand dollar issuance. KfW will join the supranational, after mandating banks for a tap of 10 year Kangaroo bonds.

-

The African Development Bank is set to sell its first fixed rate Kangaroo in over a year on Tuesday, opening the week in non-core dollars. While guidance is aggressive compared to AfDB’s Kangaroo secondaries, syndicate bankers expect an attractive spread over other supranationals to propel the deal to success.

-

This week's scorecard focuses on the funding programmes of some of the major supranational borrowers. Next week's scorecard will feature European agencies.

-

Sterling’s strong start to the year showed no sign of letting up on Tuesday as the European Investment Bank and Swedish Export Credit Corporation raised £750m between them. The strong flow could be a fixture of the year, with some issuers that returned to the currency in January already mulling more deals.