Covered Bonds

-

Danske Bank’s first covered bond of the year offered an attractive spread relative to its Nordic peers, which made it a relatively straightforward sell. But even so, the final level was just one third of Danske’s differential against Sweden a year ago.

-

Danske Bank has mandated joint leads for a euro seven year benchmark, which is expected to be priced on Tuesday. The Danish bank had been expected to make a deal announcement some time ago, but decided to hold back after some tightly priced core covered bond deals failed to garner a sizeable book.

-

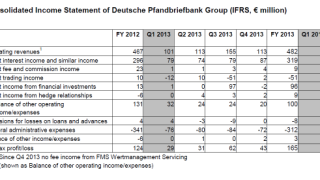

Deutsche Pfandbriefbank (Pbb ) reported a 31% pre-tax rise in profit on Monday, boding well for its privatisation — in marked contrast to Depfa plc. Pbb has launched two Pfandbrief deals this year and is likely to return to markets at least once and possibly twice this year, it confirmed to The Cover on Monday. For the time being, however, the covered bond market is expected to trade sideways as participants await news from the European Central Bank.

-

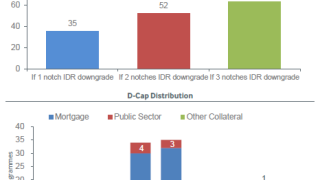

The ratings of covered bonds programmes could withstand a downgrade of the issuer’s rating by two notches on average, up from one notch in mid-March, said Fitch on Monday. But that analysis follows a Moody’s announcement in which it placed 81 European banks on negative outlook due to “systemic support for unsecured creditors being increasingly at risk” following the implementation of the Bank Recovery and Resolution Directive (BRRD). The upshot is that an improved covered bond rating cushion may prove to have little effect on covered bond ratings as issuer ratings are more likely to be downgraded.

-

Non performing loans in multi-Cédulas deals are continuing to rise according to Moody’s. And Bank of Spain data released last week showing that the trend maybe levelling off, understates the actual level by as much as half. See The Cover's interactive chart for more.

-

The European Central Bank (ECB) has introduced a new field to its asset eligibility function which shows more detail on whether a covered bond is compliant with the capital requirements directive. Despite some teething problems, it is likely to prove helpful in showing covered bond holders whether their investment is eligible for preferential regulatory treatment.

-

The regulatory herding of investors into covered bonds and away from the high quality end of the ABS market may soon be about to end. The Bank of England and European Central Bank joint report on securitization, published on Friday, suggests that the two central banks are going to even the regulatory playing field between the two not-so-different asset classes.

-

The covered bond supply outlook is set to improve next week, but with the European Central Bank (ECB) possibly set to embark on targeted asset purchases, covered bond analysts have become more guarded on the medium term supply outlook.

-

Lloyds Bank announced a tender for three short-dated covered bond deals denominated in euros and sterling on Tuesday in its second liability-management exercise in covered bonds within the past year.

-

The primary covered bond market is set to pick up next week, with deals from issuers in the UK, Germany and New Zealand in the offing. Yorkshire Building Society announced its intention to go on the road and bring its first euro deal in five years, Westpac New Zealand has said it also launch a roadshow next week to market the first covered bond since the country enacted a legal framework and Dexia Kommunalkreditbank is set to return with its first deal since 2011.

-

Veneto Banca and Rabobank have mandated leads for RMBS. The deals offer a generous pick up to what investors could expect in covered bonds given their comparably low risk.

-

A spate of Turkish senior unsecured deals this week has raised hopes that covered bond issuance will soon follow, especially since two banks have now registered mortgage programmes. However, the cost of the cross-currency swap is too high and must fall further if banks’ mortgage loan books are to be funded through euro covered bonds on a sustainable basis. In contrast, because SME assets are higher yielding they can bear the cost of swaps, suggesting that a euro SME-backed Turkish covered bond is more likely to be seen first.