Covered Bonds

-

Berlin Hyp is set to open books for a quick-fire five year on Monday and ahead of the Germany-Portugal World Cup match later that day. MuHyp and BPCE have also mandated leads.

-

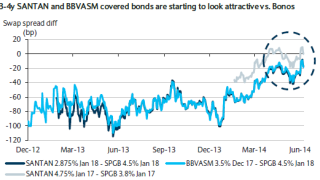

Following the June 5 ECB announcement Bonos have rallied strongly, while Cédulas have reacted to a lesser extent, leaving clear performance potential, a Barclays research note published on Thursday argues. But what is nice in theory is more difficult in practice, traders said — large blocks of Cédulas are difficult to source without pushing up prices.

-

The EBA have decided that they really don’t think it is a good idea that aircraft pfandbrief get a preferential risk weight along with other types of covered bond. Economically that is fairly trivial, there are only €1bn of these bonds outstanding and, since it is doubtful that many are held in banking books, it is questionable if they would get any benefit from a better risk weighting.

-

The Austrian government's decision on winding up Hypo Alpe Adria is a sign of waning state support said Fitch on Friday. The announcement comes as Standard & Poor’s put the ratings of seven Austrian banks on credit watch negative, leading Commerzbank research to suggest selective Austrian covered bonds could soften.

-

Mediobanca was the sole covered bond issuer to put its head above the transaction parapet on Tuesday morning — the first deal following Mario Draghi’s speech on June 5. Offering a €750m five-year single-A trade to a supply-hungry market, the deal was priced at least 3bp through fair value, according to a lead banker on the deal — a clear signal that the periphery tightening story is not over yet.

-

Covered bonds maintained primary market momentum this week, but issuers adopted very different pricing strategies and delivered contrasting outcomes. The degree of hesitancy that had been evident in the run up to last week’s European Central Bank meeting disappeared with a robust bid returning for higher yielding bonds. In contrast, low beta deals that offered a negligible spread were only just subscribed.

-

The European Banking Authority (EBA) believes covered bonds should keep their preferential risk weighting in principle, but that the market needs reform. It wants covered bond frameworks to converge to a common standard in certain important areas, and it may need this within a two-year time frame.

-

The preferred regulatory status of covered bonds is not about to be withdrawn but, in light of recent comments from the European Central Bank’s executive board member, Yves Mersch, it is likely that regulators will increase their scrutiny of the product. His remarks dovetail with the European Banking Authority’s initiative to set a definitive standard for all covered bonds.

-

A draft document circulated by the European Commission suggests that banks will need to sell a representative sample of their covered bond liquidity portfolio as a condition for their eligibility into the top rank of the liquidity coverage ratio (LCR). The clause is likely to be welcomed by dealers but is not fit for purpose because it will not demonstrate liquidity in times of stress.

-

Royal Bank of Canada opened books on Thursday for its keenly anticipated inaugural covered bond of 2014. The deal builds its euro curve and establishes RBC as the benchmark Canadian issuer in euros. Though wider than its last five year, the 0.75% coupon was 0.5% below its last funding in this duration and shows the impact of the ECB's recent action.

-

Deutsche Kreditbank (DKB) opened books on Wednesday on an Aa1-rated €500m 10 year mortgage-backed Pfandbrief, its second deal of the year and the third 10 year print to come out of Germany in 2014. A lead banker on the deal described the reception as tepid — a further indication of investor frustration with slender coupons offered by second tier Pfandbrief issuers, particularly on longer tenor bonds.

-

The European Banking Authority (EBA) believes that the preferential risk weighting for covered bonds is warranted in principle. However as covered bonds issuers can fail, covered bond frameworks should converge to a common standard in certain important areas, and this may need to be implemented within a two year time frame, said the regulator on Tuesday.