Covered Bonds

-

Credit Mutuel CIC Home Loan SFH mandated and issued a €1bn 10 year deal on Tuesday. Despite a minimal new issue premium and the lowest 10 year coupon from a non German issuer, the borrower still managed to attract a comfortably oversubscribed book.

-

-

Mediobanca was the sole issuer to put its head above the transaction parapet on Tuesday morning following Mario Draghi’s speech on Thursday. Offering a €750m five-year trade to a supply-hungry market, the deal priced at least 3bp through fair value, according to a lead banker on the deal — a clear signal that the periphery tightening story is not over yet.

-

Deutsche Kreditbank has mandated leads for its second deal of the year and the third 10 year issued from Germany this year. Meanwhile, there is speculation that several Canadian issuers could return to the euro market.

-

The European Banking Authority will hold a public hearing on covered bonds on Tuesday with a view to establishing best practice in the market. The hearing could ultimately lead to a level of standardisation being imposed in order for covered bonds to continue to receive preferential regulatory treatment from European authorities.

-

While markets on the continent were closed for business on Monday due to public holidays, syndicate bankers in London were planning a busy week ahead. With a broadly positive reaction to European Central Bank president Mario Draghi’s Thursday speech seen across credit markets into the end of last week, conditions remain strong for primary issuance. On Friday the iTraxx Senior index closed 8bp tighter to a new post-2008 low of 60bp. The pipeline could include deals from Westpac New Zealand and Caisse Centrale Desjardins du Quebec.

-

Veneto Banca has issued its second RMBS in as many months, while Banca Sella was set to price its first RMBS deal since 2005 on Friday. The short dated single A rated deals, that offered a compelling triple digit spread, will give covered bonds a run for their money for investors that understand the risk.

-

Two of the strongest RMBS platforms in the European securitization market hit the market this week, and showed investors are still eager to grab the highest quality paper.

-

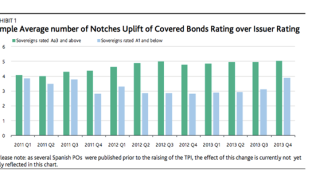

Moody’s released its quarterly treasure trove of covered bond rating trend analysis in ‘Global Covered Bonds Monitoring Overview: Q4 2013’ this week. The agency identified a widespread increase in timely payment indicators (TPIs) for covered bond programmes in countries with a sovereign rating of A1 and below as the key trend.

-

Covered bond secondary markets opened on a much firmer footing on Friday, with dealers and clients singling out higher yielding weaker credits, particularly in the periphery, where offers are hard to find. The move came after Thursday’s stimulus package from the European Central Bank, and after Standard and Poor’s upgraded several Spanish banks.

-

The widely anticipated public sector-backed Pfandbrief from Dexia Kommunalbank on Tuesday had been expected to go well, given the juicy spread that was expected. But the level of oversubscription proved a surprise and was the highest of any German deal this year — even putting competing issuance from Portugal into the shade.

-

OP Mortgage Bank on Wednesday returned for the second time this year to issue a €1bn five year covered bond. Despite pricing at the tightest spread for any Finnish transaction in the last five years and with a negligible new issue premium, it still attracted a robust level of oversubscription.