CITIC Group

-

-

China Citic Bank International and Bank of East Asia are leading the transaction

-

About 90% of the existing lenders are expected to support the refinancing

-

The Hong Kong-listed company returns to loan market after eight years

-

Chinese developer is looking to exchange three bonds due to insufficient liquidity

-

The borrower sealed two deals last year

-

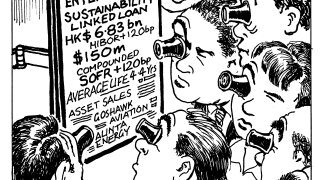

The sustainability-linked loan found solid demand, with the deal landing at $912m

-

Jewellery-to-property firm makes loan return, soon after divesting some of its assets

-

Chinese wind turbine maker raises money to refinance a 2019 borrowing

-

Chinese bank hires senior loans bankers from UOB and MUFG

-

Chinese conglomerate gets a nearly five times book as the only dollar bond issuer on Thursday

-

The company is hoping to benefit from its parent’s background to woo lenders in a difficult market