China Construction Bank Corp CCB

-

-

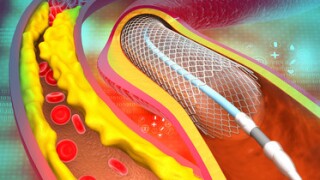

Chinese stent maker dashes out for a listing before Christmas

-

Mala snacks maker has parked over half of its deal with cornerstones

-

The two firms are testing investor appetite for their listings

-

Chinese cancer immunotherapy drug producer parks over half of the deal with cornerstone investors

-

Chinese insurance provider will start taking investor orders at the end of November

-

-

Bookbuilding launched on Monday morning, with cornerstones taking up about 36% of the deal

-

Bookbuilding is likely to launch next week, with bankers refuting rumours the IPO is on hold

-

Chinese property manager brings IPO back to life amid crisis in the sector

-

The agriculture company looks to refinance debt ahead of a planned onshore IPO

-

The bond has a 'deeper green' shade as it is the first deal under the EU and China’s joint green taxonomies