Turkey

-

Turkey still has $6bn of funding to source this year after two new issues so far

-

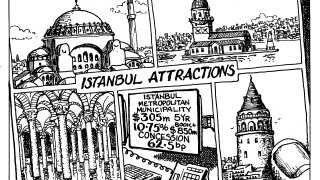

The municipality is the first Turkish non-sovereign issuer since mid-January

-

-

The government's lira deposit scheme means Turkish banks are looking to dollarise

-

Bankers had suggested any dovish tilt from the Fed would lead to new EM issues

-

Headwinds build for the Turkish sovereign but it should still be able to service its debts

-

DMO a beacon of reassurance to markets amidst the mayhem

-

Relief as Turkey sells largest ever new issue but doubt lingers over country's other credits' access to capital markets

-

Islamic buyers flock to generously priced deal

-

Turkey mandates for first sukuk since currency carnage

-

Investors and banks believe Islamic format is the best way for Turkey to regain capital market access

-

Sentiment in the CEEMEA bond market has improved but not enough to let Turkish issuers off the sidelines