South America

-

-

Telco and oil company begin investor calls ahead of dollar benchmarks

-

Chilean railway company raises $500m of 40 year paper in first LatAm benchmark for a month

-

-

David Flechner returns to law firm after three years and will split time between São Paulo and New York

-

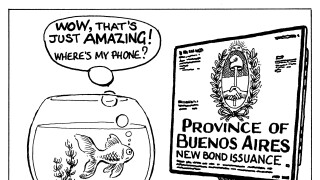

Argentine province already has the approval of 63.7% of its bondholders

-

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

Investors say dollar bonds yet to fully price in uncertainty

-

Bankers say Chilean issuers will dominate early autumn supply from Latin America as Alfa Desarrollo eyes $1.2bn bond

-

Argentine power company will issue $366m of green bonds as part of debt exchange

-

Moody’s says Colombian oil company faces higher leverage and refinancing risk due to its more aggressive financial policy

-

Argentina’s largest province notches 98% approval for its bond exchange, meaning new 2037 issue will surpass $5bn