South America

-

The City of Buenos Aires is likely to sell a peso-denominated bond to both domestic and international investors mid to late this week, according to a banker with knowledge of the deal.

-

Investors and bond market analysts said that PDVSA, the Venezuelan state-owned oil company, was on the verge of a messy default after making its latest principal payment nearly a week late and in various stages.

-

The more we learn, the less we know about what happens next when it comes to Venezuelan debt.

-

Brazilian pulp and paper producer Suzano Papel e Celulose is looking to buy back a further $300m of its existing 2021s, just a month after wrapping up a previous tender offer for the same notes.

-

Holders of PDVSA’s 2017 bonds were suddenly filled with dread by Tuesday’s close as rumours of the overdue maturity payment being made could not be confirmed. Its credit default swap price worsened on the expectation a credit event would be declared.

-

While it is tempting to think of capital markets-friendly President Mauricio Macri as having wiped Argentina’s slate clean, it is not yet time for EM investors to forgive and forget.

-

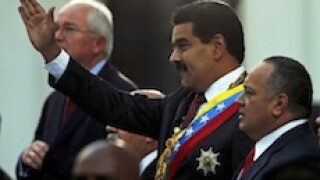

President Maduro’s surprise restructuring announcement only makes things murkier for Venezuelan bondholders.

-

Despite Venezuela offering some further colour on its proposed debt restructuring on Friday, the government’s plan is still unclear as its bond prices plummeted.

-

Brazilian investment bank BTG Pactual is looking to buy back 30% of old perpetual notes via a tender offer it will finance with cash.

-

Venezuelan president Nicolás Maduro’s announcement on Thursday that he would restructure the country’s debt left bondholders in “no man’s land”, after he appointed a politician that no US person is allowed to deal with as head of the restructuring group.

-

Argentine lender Banco Hipotecario and Colombian utility EPM sold local currency deals on the international market this week but market participants said a limited buyer base is restricting momentum in these types of trades.

-

Inkia Energy, the Latin American power generation and distribution holding company, returned to the bond market on Thursday with a deal that divided opinion on relative value but performed strongly in the grey market.